Advertisement

Advertisement

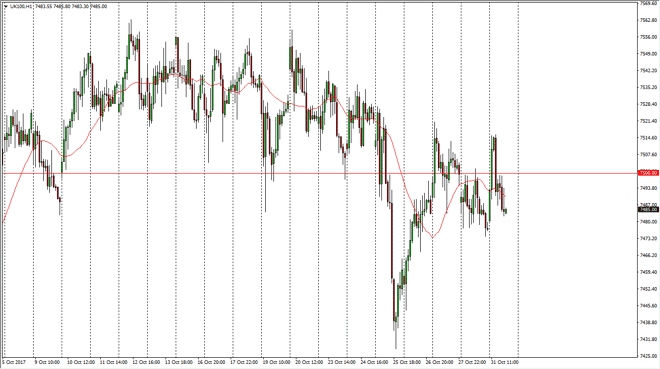

FTSE 100 Index Price Forecast November 1, 2017, Technical Analysis

Updated: Nov 1, 2017, 05:38 GMT+00:00

The FTSE 100 has been all over the place during the Tuesday session, as we sliced around the 7500 level. Because of this, I think it’s probably best to

The FTSE 100 has been all over the place during the Tuesday session, as we sliced around the 7500 level. Because of this, I think it’s probably best to sit on the sideline until we either get some type of impulsive move to the upside, or perhaps the downside. In the meantime, I am watching the 7525 level to the upside, and the 7475 level to the downside. If we can break down below there, the market could continue to go much lower, perhaps reaching towards the 7425 level. If we do break to the upside, the market should then go to the 7550 level. The market continues to be very noisy, as the British pound has been very volatile as well. Ultimately, I think that we should go higher, but if we can break above the 7560 level, the market will be free to go much higher, perhaps the 7600-level next.

The alternate scenario of course is breaking down, and if we do we probably go down to the 7400 level, followed by the 7300 level which is massive support. Ultimately, this market continues to cause a lot of noise, so I suspect that options might be the best way to play the FTSE 100 in the short term, unless of course you have the ability to buy small positions and hang onto a bigger move. I do recognize that eventually we should go higher, but I also keep the negativity in mind as well, as obviously the market can go both directions. Caution will be needed, but eventually we should get some type of clarity in the market that we can follow. Until then, patience will be needed so that we can get a clear signal to take advantage of.

FTSE 100 Video 01.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement