Advertisement

Advertisement

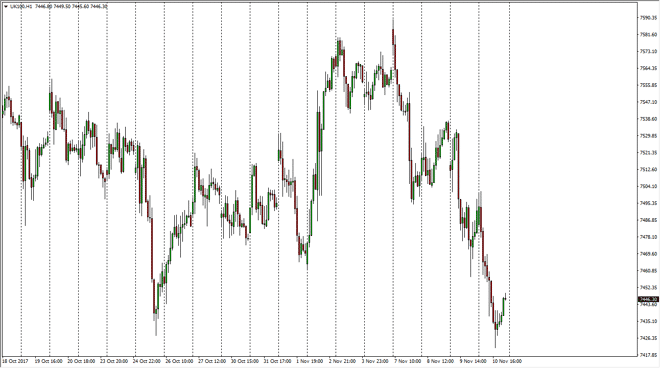

FTSE 100 Index Price Forecast November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:09 GMT+00:00

The FTSE 100 fell rather significantly during the day on Friday, making a fresh, new low. We bounced a bit from the 7420 region, but look likely to roll

The FTSE 100 fell rather significantly during the day on Friday, making a fresh, new low. We bounced a bit from the 7420 region, but look likely to roll over from here. At this point, I’m waiting to see some type of exhaustive candle or roll over that I can start selling. I think that the FTSE 100 will continue to struggle, perhaps reaching down to the 7400-level underneath, and a breakdown below there could send this market even lower, perhaps down to the 7300 level. This is a market that continues to be very choppy and volatile, but most certainly has a lot of bearish pressure involved in. Alternately though, I believe that there is plenty of support underneath that will eventually lift this market, but I think it’s probably to be found closer to the 7400 level, and if not there, the 7200 level as dictated upon the weekly charts.

Overall, I believe that the markets should continue to go much higher, but it is unlikely that we can continue the momentum to the upside immediately. I think we need to pull back to find enough support underneath and more importantly value that we can take advantage of. Ultimately, I think that the 7600 level above is the target, but I think given enough time we can break above there and continue to go even higher. Based upon the weekly chart, break above the 7600-level census market looking towards the 8000 handle. That’s my longer-term thesis, so therefore it of course influences my short-term trading as well. The market continues to be very volatile, and in the short term, very negative for what I see. Overall, I think that this is a time of value building by selling.

FTSE 100 Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement