Advertisement

Advertisement

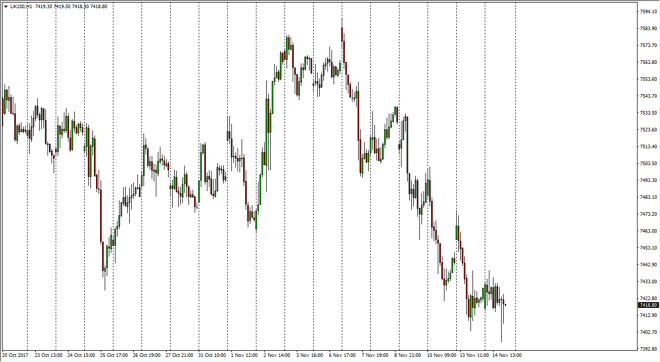

FTSE 100 Index Price Forecast November 15, 2017, Technical Analysis

Updated: Nov 15, 2017, 05:32 GMT+00:00

The FTSE 100 continues to be very noisy, as the Tuesday session was more of the sideways and back and forth action. The 7400-level underneath continues to

The FTSE 100 continues to be very noisy, as the Tuesday session was more of the sideways and back and forth action. The 7400-level underneath continues to be support, and I think that we could get a bit of a bounce from here. However, the market may need to go sideways for a while, building up enough momentum and interest to rally again. After all, the FTSE 100 has been very bullish for some time, and while the British pound isn’t necessarily falling anymore, it’s not exactly historically expensive either, meaning that it’s likely that we will continue to see the FTSE 100 favor the upside as British exports remain cheap. Beyond that, we also have the likelihood that traders are simply taking a break as equities around the world have gotten a bit overvalued. That’s not to say that they are overvalued for the long term, but I do believe that the buying has gotten ahead of itself.

With a pattern that we see right now, it’s likely that this is the beginning of a base, but if we were to break down significantly below the 7400 level, I think the 7300 level makes quite a bit of sense next, but with even more support at the 7200-level underneath which is the bottom of the larger consolidation area. That consolidation area extends from 7200 to the 7600 level above, so therefore we are essentially a “fair value”, but it looks as if we may find more support here than in the past, as it is an extension of the longer-term uptrend. Quite often, consolidation will only reach back towards the middle point of the range before breaking out to the upside. We have been sideways for a while, so I think that perhaps the momentum is starting to pick up for a case to the upside.

FTSE 100 Video 15.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement