Advertisement

Advertisement

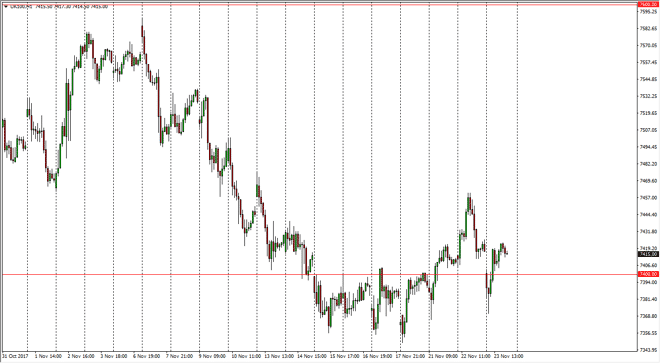

FTSE 100 Index Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:06 GMT+00:00

The FTSE 100 gapped lower at the open on Thursday, breaking down below the 7400 level. On the hourly chart though, we ended up forming a nice-looking

The FTSE 100 gapped lower at the open on Thursday, breaking down below the 7400 level. On the hourly chart though, we ended up forming a nice-looking hammer, and a break above the 7400 level after that is a bullish sign. It looks as if we are going to continue to go higher, perhaps reaching towards the 7450 level, and then eventually the 7500 level above. I think the fact that we have made a “higher low” we could see the market reach back towards the 7600 level again as we have seen that area to be a selling in the consolidation area that we have been dealing with longer term. The fact that we are starting to find support at the 7400 level is interesting to me, because it was previously “fair value”, suggesting that perhaps we are going to try to build up enough momentum to break out and continue the longer-term uptrend. I certainly have an upward bias anyways, so given enough time, it’s likely that we will find buyers.

Alternately, if we were to break down below the 7350 level, then I think the market goes down to the 7200 level which is the bottom of the longer-term consolidation area. However, right now I think that it looks very likely that the FTSE 100 will continue the upward momentum, as we have filled the gap and looks likely to rally from there. Once we clear the 7450 handle, it’s almost a straight shot towards the 7600 level. A break above there and the extension of the uptrend is a sign that we will probably try to get to the 8000 handle, based upon the measured move. Longer-term, that’s what I expect but I recognize the volatility will be a major issue occasionally.

FTSE 100 Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement