Advertisement

Advertisement

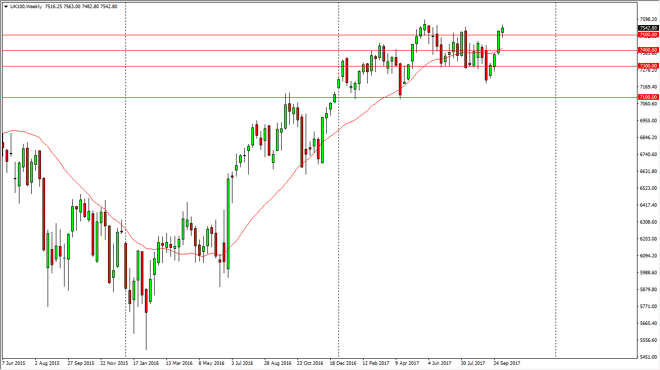

FTSE 100 Index Price forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:33 GMT+00:00

The FTSE 100 initially fell during the week, but then turned around to rally significantly. The 7500 level should now offer support as it was resistance

The FTSE 100 initially fell during the week, but then turned around to rally significantly. The 7500 level should now offer support as it was resistance in the past, but I do recognize we could get a bit of volatility as we are a bit overextended currently. I think that eventually we should reach above the 7600 level, and then reach towards much higher levels. I think that these pullbacks that could occur should find plenty of buyers down to the 7300 level, which would be thought of as value. I believe that the FTSE 100 continues to favor the upside as the British pound is historically week. Yes, it has been rallying as of late, but in the end it still makes British exports cheap, which of course helps the FTSE 100 in general.

I have a target of 7600, followed by 8000 over the longer term. I think it might be the end of the year before we reach 1000 though, because we are starting to lose some of them necessary momentum in the past. Ultimately, I think that the market should continue to find plenty of reasons to go long, as not only is the British pound cheap, but we also have a strengthening global economy. In general, the market has favored buying stocks, and of course England is again to be any different. The question then arises as to whether if the English markets can rally the same way some of the other ones have. Ultimately, I believe that there is going to be a certain amount of volatility due to potential headlines coming out of both London and Brussels, so don’t forget that. Be careful, but I think the buyers are most certainly in control.

FTSE 100 Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement