Advertisement

Advertisement

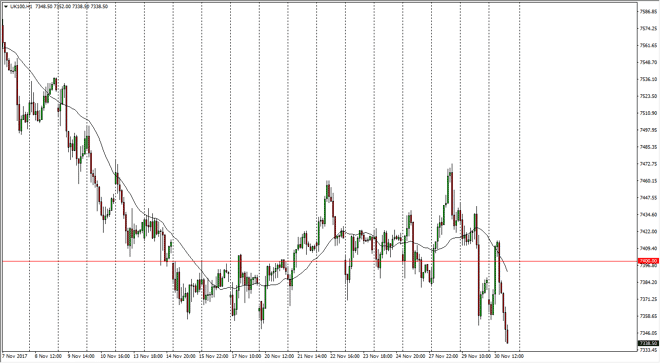

FTSE 100 Price Forecast December 1, 2017, Technical Analysis

Updated: Dec 1, 2017, 04:10 GMT+00:00

The FTSE 100 initially looked bullish during the trading session on Thursday, but as you can see, we have broken down significantly to make a fresh new low.

The British index initially tried to rally during the trading session on Thursday, but found a lot of trouble above the 7400 level. By turning around and rolling over, we have made a fresh, new low, and I suspect at this point we are going to go looking towards the 7300-level underneath, and a breakdown below that level should be a very negative sign indeed. At this point, I believe that we are going to go looking towards the bottom of the overall consolidation, which is the 7200 level. Over the last several months, we have been bouncing around between the 7200 level on the bottom and the 7600 level on the time, and this looks as if we are ready to continue that consolidation.

Any rally at this point in time is probably going to be a selling opportunity at the first signs of exhaustion, especially as we would approach the 7400 level. A break above the 7450 level would send this market back towards the 76 are level, but that seems to be very unlikely given the negativity of the move during the trading session on Thursday. I think that we will find plenty of buyers near the 7200 level though, so this is probably more of a short-term move, followed by a bounce just waiting to happen. I believe that disappointment with the lack of a deal between the UK and EU may be weighing upon the FTSE 100, but in general we are having a bit of a “risk off” session in various markets around the world. However, I feel that value hunters will be attracted to this market at lower levels.

FTSE 100 Video 01.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement