Advertisement

Advertisement

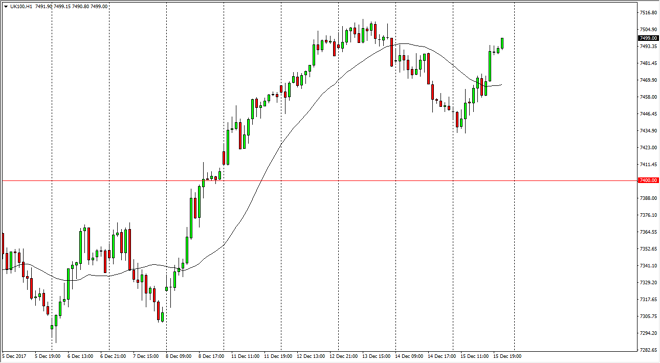

FTSE 100 Price Forecast December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 04:57 GMT+00:00

The FTSE 100 rallied significantly during the trading session on Friday, reaching towards the 7500 level. This is an area that of course would cause issues, based upon the psychological importance of it. It was also the highs from Wednesday, so it’s likely that we will continue to see noisy action.

The FTSE 100 continues to be very bullish, and the fact that we reach towards the 7500 level tells me that the market is ready to break out to the upside again, and go towards the 7600 level. The reason this is important as it is the recent highs from the consolidation overall, and I think that means that the market is trying to build up the necessary momentum to break out to the upside, and fulfill the overall movement based upon the rectangle that we are currently stuck in. That has the FTSE 100 going to the 8000 level longer term. Pullbacks are value, and I believe that the 7400 level will be massively supportive.

We may not be able to break out right away, but every time we pull back it seems as if we are ready to make a higher low, meaning that we are building up momentum and that’s the most important thing. At the end of the year, the markets are trying to continue the upward momentum, and as the negotiations between London and Brussels produce some type of certainty, that should be the next catalyst to send the FTSE 100 higher. If we were to break down below the 7400 level, that could change things in my opinion, perhaps send in the market down to the 7200 level although it is the least likely of scenarios that I see currently. In general, buying on the dips and adding slowly continues to be my strategy this time a year.

FTSE 100 Video 18.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement