Advertisement

Advertisement

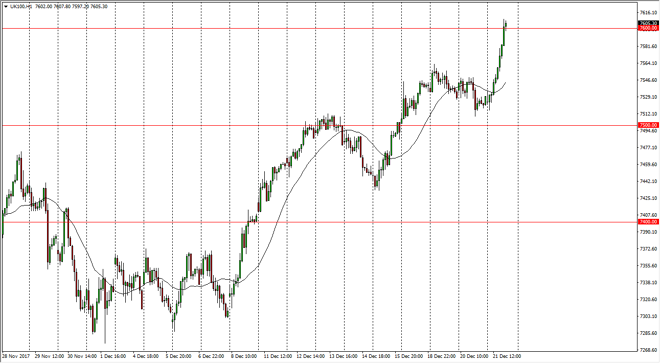

FTSE 100 Price Forecast December 22, 2017, Technical Analysis

Updated: Dec 22, 2017, 05:48 GMT+00:00

The FTSE has exploded to the upside during the trading session on Thursday in thin volume. What’s more important though, we are reaching towards the top of the overall consolidation area that we have seen recently.

The FTSE 100 rallied significantly during the trading session on Thursday, showing signs of strength. As we are touching the 7600 level, it’s interesting as it is the top of the overall consolidated area that we have been in for some time. If we can break above the 7600 level, the market could continue to go much higher, based upon the measurements. Based upon the overall consolidation area, the market is expected to reach towards the thousand handle, but that’s obviously a longer-term move. The 7800 level above is the initial target, but I think it’s only a matter of time before we reach the 8000-handle based not only upon the measurement, but the fact that it is a large round number.

Pullbacks of this point could be buying opportunities, and I think now that the 7500 level is going to be the floor. The floor I think continues to attract a lot of money, as the markets have been bullish over the longer term, but recently have been grinding sideways in general to digest gains, and perhaps begin to feel comfortable with higher levels. If we were to break down below the 7500 level, the market could drop towards the 7400-level underneath, but I think that’s the least likely of scenarios, especially considering how explosive the move to the upside has been. Add slowly, but I believe in buying on the dips going forward as you can build a larger core position. The move on Thursday has been a bit parabolic, but obviously bullish.

FTSE 100 Video 22.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement