Advertisement

Advertisement

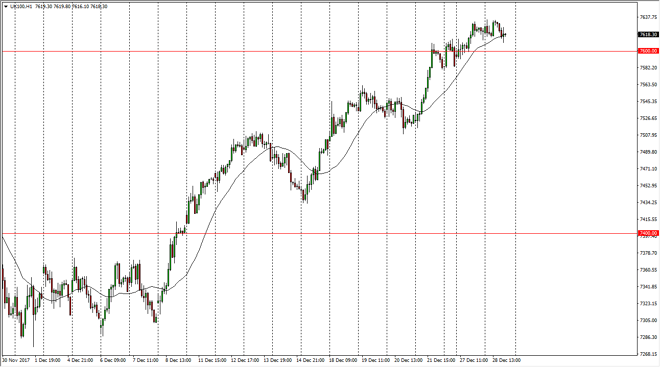

FTSE 100 Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:55 GMT+00:00

The FTSE 100 went sideways during the session on Thursday, bouncing along the 7600 level. The 7600-level course offers a lot of support, as it was previously resistive.

The FTSE 100 has gone sideways in general over the last couple of sessions, after breaking above the 7600 level. The 7600 level should now offer support, and that being the case, it’s likely that we will continue to see buyers jumping into this market, and the measured move could have this market looking towards the 7800-level next, and then eventually the 8000 level. I think given enough time, the market should continue to see buyers on dips, as the FTSE 100 has been very active. However, this summer years difficult to build up the necessary momentum to go higher on the longer-term.

I believe that the 7580-level underneath has been supportive, and if we can break down below there it would be a very negative sign. However, in the meantime I think that the buyers continue to go higher and therefore I look at these dips as small buying opportunities, and that should be the main theme of this market place, as we continue to see a lot of value hunting in this market place. We should continue to go much higher, but you’re going to have to be very patient and keep your position size a bit small in the meantime. Longer-term, I don’t see any reason we don’t go to the 80,000 handle.

We have a lot of headline risk in this market, as the negotiations between Brussels and London continue to offer a significant risk to the overall flow of money. In general, I believe we go higher, but be aware that the sudden shift in attitude can create buying opportunities.

FTSE 100 Video 29.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement