Advertisement

Advertisement

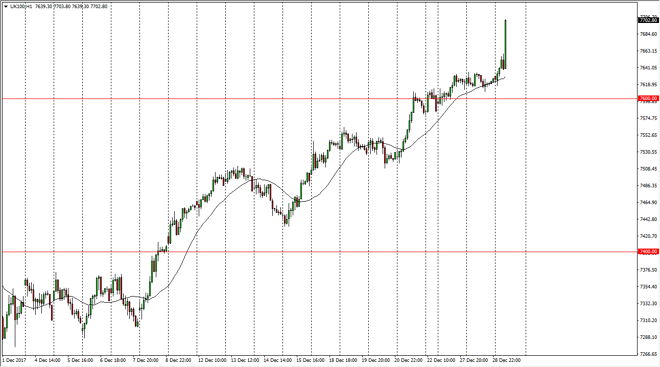

FTSE 100 Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:14 GMT+00:00

The FTSE 100 exploded to the upside during the trading session on Friday, reaching towards the 7700 level. That is an area that could offer a bit of psychological resistance, but based upon longer-term charts, there’s nothing there.

The FTSE 100 exploded to the upside during the trading session on Friday, in what would have been thin trading. However, we have been going higher for some time, so I write frankly am not surprised, as I believe that the FTSE 100 is going to continue to go much higher. I think that the 7600 level offers support underneath, and essentially the “floor” of the market just waiting to happen. Those pullbacks that will certainly return, it’s going to be looked at as buying opportunities. Longer-term, I anticipate that we will not only go well above the 7700 level, but we will look at this yet another “blip on the radar.”

The 7600-level underneath being broken to the downside would be very negative, and could send the market looking for the 7500-level underneath. The marketplace is often going to be volatile, but I think that we most certainly have enough bullish pressure to continue to move this market higher. I think that there will continue to be optimism flowing into the United Kingdom, as the historically cheap British pound makes exports cheap, and of course we should continue to see value hunters buying British companies that have been beaten down.

Ultimately, if we break down below the 7500 level, that would be a very negative sign. It seems very unlikely though, and therefore I believe that “buy on the dips” continues to be the mantra of longer-term traders, and therefore short-term traders can take advantage of this phenomenon over the next several months.

FTSE 100 Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement