Advertisement

Advertisement

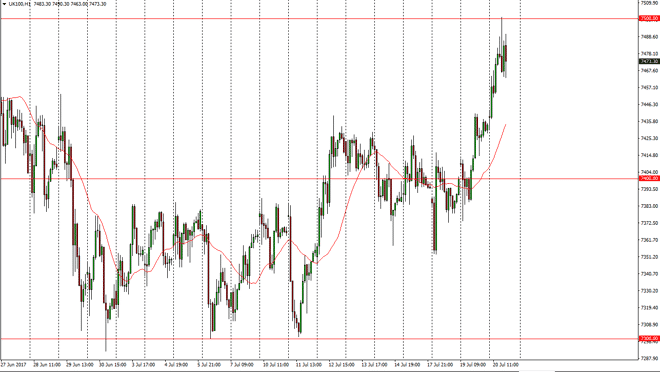

FTSE 100 Price Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:28 GMT+00:00

The FTSE 100 rallied during the day on Thursday, slicing through several minor resistance barriers. However, the market reached towards the 7500 level,

The FTSE 100 rallied during the day on Thursday, slicing through several minor resistance barriers. However, the market reached towards the 7500 level, which of course is a large, round, psychologically significant number. The fact that we managed to reach that level is a very bullish sign, and although we may pull back slightly from here, it should be an area that I think the market will eventually break above. We have been in a long-term uptrend, and on the hourly chart you can see that over the last several weeks had formed a “W pattern”, so with this being the case it’s likely that the buyers will become very aggressive. Once we break above the 7500 level, I think it will only supercharge the move higher. I don’t have any interest in shorting the FTSE 100, as we have seen a very bullish and impulsive move recently.

Buying dips

I continue to look at dips is value, and believe that eventually the FTSE 100 will not only break the 7500 level, but continue to go much higher than that. I believe that as time goes on, it will become easier for people to fathom the idea of British exports going on beyond the agreement with the European Union, and therefore most measures of the United Kingdom’s economy are cheap. I believe that the 7400-level underneath should be massively supportive, and therefore it’s not until we break down below there that I would consider selling. Ultimately, I believe looking for value as the best way to go going forward, and that means buying small and shallow dips that will almost undoubtedly appear from time to time. Over the next several weeks, I anticipate that this market may go looking for the 7600 level.

FTSE 100 Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement