Advertisement

Advertisement

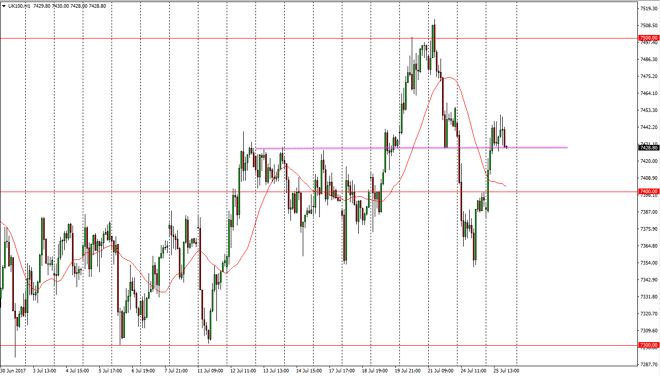

FTSE 100 Price Forecast July 26, 2017, Technical Analysis

Updated: Jul 26, 2017, 04:41 GMT+00:00

The FTSE 100 broke to the upside during the session on Tuesday, clearing the 7400 level. This is a very bullish sign, and I believe it should come as a

The FTSE 100 broke to the upside during the session on Tuesday, clearing the 7400 level. This is a very bullish sign, and I believe it should come as a lot of people to take note. I believe that the 7400-level underneath should be supportive, and I believe that buyers will return somewhere in that area. Don’t forget the influence of the British pound, as it rises it puts a bit of a weight around the neck of British exports and that of course has an influence in this market. The currency markets will be lightly today as the Federal Reserve decides what is doing next. This will have a bit of an effect on this market as well, but right now I still like the upside overall. I believe that the next target is the 7500 level but we won’t necessarily go there right away. Ultimately, this is a market that should be supported down to the 7350 handle, so it’s likely that we could get a pullback that show signs of buying pressure underneath.

Buying dips

I continue to be a buyer of dips in this market, and I believe that we will eventually break out to a fresh, new high and continue to extend gains towards the 7600 level. I don’t have any interest in shorting, least not until we break down below the 7350 handle, which would send this market looking for the 7300 level next, and perhaps even lower than that given enough time. Either way, expect a lot of volatility and noise in this market as we continue to be at the mercy of headlines coming out of the negotiations between the European Union and the United Kingdom, and of course the currency markets which should be quite lively today.

FTSE 100 Video 26.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement