Advertisement

Advertisement

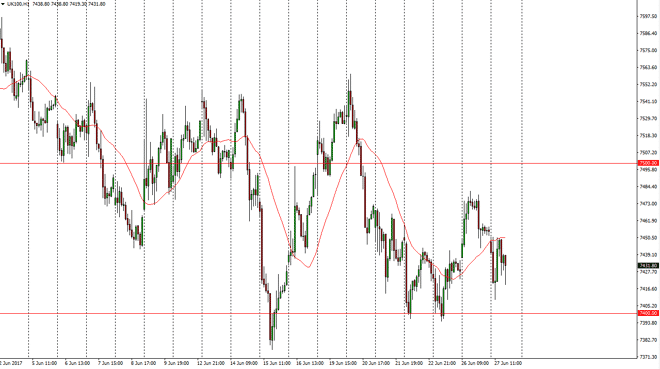

FTSE 100 Price Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:47 GMT+00:00

The FTSE 100 fell initially during the day on Tuesday, but then bounced enough to wipe out all the losses, only to turn right back around. It looks as if

The FTSE 100 fell initially during the day on Tuesday, but then bounced enough to wipe out all the losses, only to turn right back around. It looks as if we are trying to consolidate just above the 7400 level, as the 7450 level above is resistance. The market continues to go back and forth, showing signs of choppiness. I believe that the market is trying to build up enough momentum to turn around and go to the upside, as the 7400 level is important on the longer-term charts. However, the market has been so choppy, it makes sense that longer-term traders will be looking to add to their position slowly. Ultimately, a breakdown below the 7400 level should signify bearish pressure, especially for we clear below the 7380 handle. With that being the case, it’s likely that the volatility will continue.

Longer-term trend

I believe that longer-term trend is bullish, so I think it’s only a matter of time before we rally. With this being the case, I think that the market will eventually reach towards the 7500 level, and then break above there to go much higher. The market continues to be volatile due to the headlines coming out of London, as we continue to hear noises coming out of the negotiations between the United Kingdom and the European Union. Because of this, I think that this market will be choppy but longer-term the market will recognize the value in British exports, as the FTSE 100 is laden with export companies in the United Kingdom. Because of this, I like the upside in this market but I recognize that the choppiness will probably continue, so adding slowly to a long position is probably the best way to go in a market that should favor the upside longer term.

FTSE 100 Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement