Advertisement

Advertisement

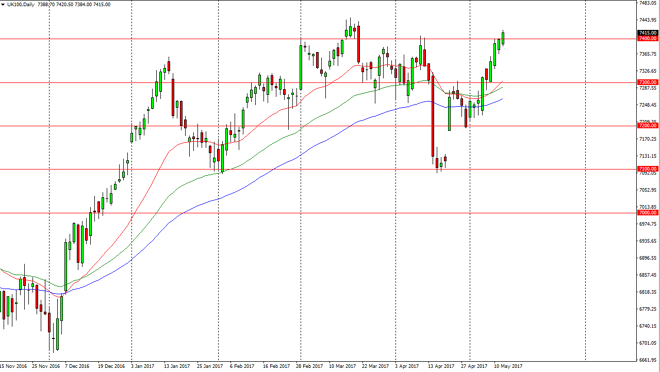

FTSE 100 Price Forecast May 15, 2017, Technical Analysis

Updated: May 13, 2017, 05:28 GMT+00:00

FTSE 100 traders push this market above the 7400 level during the day on Friday, showing signs of strength. I believe that the market is going to go

FTSE 100 traders push this market above the 7400 level during the day on Friday, showing signs of strength. I believe that the market is going to go looking for higher levels now, and that short-term pullbacks will offer value the traders take advantage of. I believe that the traders will continue to find value every time we pull back, and therefore I remain very bullish. I believe that the 7300-level underneath will continue to be the “floor, and that the market will find plenty of willing participants in that area. Once we break out to a fresh, new high, I believe the market will then go to the 7500 level above, where we would find plenty of psychological resistance. I believe that as far too juicy have a target for the traders to ignore, so it makes quite a bit of sense for traders to continue to reach towards that level.

Longer-term uptrend

I believe that the longer-term uptrend continues based upon not only the breakout above the 7400 level, but the gap that sits below. It shows that there is a significant amount of faith in this move, and that buyers continue to run the show. I have no interest in shorting, the market is far too strong. We may get some volatility due to currency moves and the British pound, but longer-term I believe that British companies are cheap, and that most traders seem to agree. It may take some time to reach the 7500 level, but I believe that’s the next place where we would make some type of longer-term decision. The market has been a bit overextended, so those pullbacks would make sense, but I feel this market is currently doing as it has over the last several months.

FTSE 100 Video 15.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement