Advertisement

Advertisement

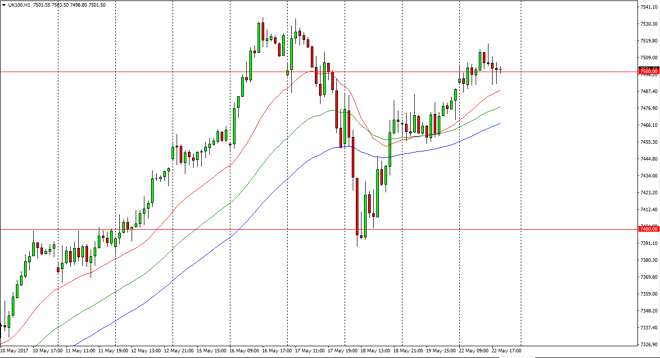

FTSE 100 Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:07 GMT+00:00

The FTSE 100 had an interesting session on Monday, gapping higher initially, and then grinding above the 7500 level. Later in the day, we continue to see

The FTSE 100 had an interesting session on Monday, gapping higher initially, and then grinding above the 7500 level. Later in the day, we continue to see the 7500 level offer support, and I believe that we are going to have buyers into the market every time we dip. I believe that the 7450 level below is going to act as a “floor” in this market, and that the moving averages that I follow should continue to be dynamic support as well. If we can get a bit of a bounce from here, the next target will be the 7550 handle, and then eventually the 7600 level. I think that the FTSE 100 will continue to benefit from the overall uptrend, and I don’t have any interest in selling, least not anytime soon.

Buying dips, adding slowly

I think that if you can buy dips in this market and at slowly to your position, it will probably be the best way to go going forward. I don’t have any interest in selling, least not until we can break down below the 7400 level which of course would be a very significant move to the downside, and more importantly: a “lower low.” Until then, you would have to assume that the uptrend is still very much intact, and although we had a significant selloff, that had more to do with Washington DC than anything going on in London. Trauma out of the White House and Congress will have little effect on British exports, so most of this selling would have been due to panic more than anything else. Because of this, I still believe in the uptrend and don’t have any interest in trying to fight it. 7600 is my next target, but I believe we go much higher than that over the longer term.

FTSE 100 Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement