Advertisement

Advertisement

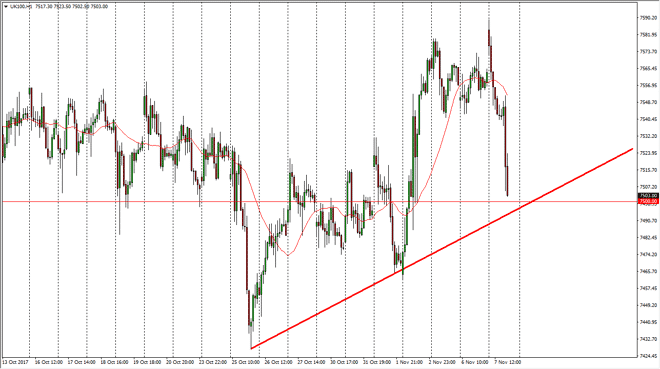

FTSE 100 Price Forecast November 8, 2017, Technical Analysis

Updated: Nov 8, 2017, 05:28 GMT+00:00

The FTSE 100 initially gapped higher at the open on Tuesday, reaching out to a fresh, new high, just shy of the 7600 level. However, we felt is not only

The FTSE 100 initially gapped higher at the open on Tuesday, reaching out to a fresh, new high, just shy of the 7600 level. However, we felt is not only filled the gap, but crashed down towards the 7500 level. This of course is a very bad technical move, and I think that we are probably going to go looking for support just below, and if we can break down below the 7480 handle, the market should then go down to the 7425 level. Alternately, if we can bounce from this general vicinity, it could be a nice buying opportunity, perhaps reaching towards the FTSE 100 highs at the 7600 level. The FTSE 100 has been bullish for some time, and I think that the market could very well find value hunters just below.

However, if we break down below the 7425 handle, that could be very negative, perhaps in this market down to the 7400 level, and then the 7300 level which I see as the “floor” in the market uptrend. The British pound of course has an effect on the FTSE 100 as well, and if the British pound cells off, that could help the FTSE 100 due to cheap exports. If we were to break above 7600 above, the market then could go much higher, perhaps reaching towards the 7750 level, and then eventually the 8000 handle. In general, the market should continue to see volatile moves, as is the case with the United Kingdom overall, as there are a lot of questions when it comes to what’s going to happen after leaving the European Union. This has been a very precipitous fall in the market, so a breakdown would not be a huge surprise at this point.

FTSE 100 Video 08.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement