Advertisement

Advertisement

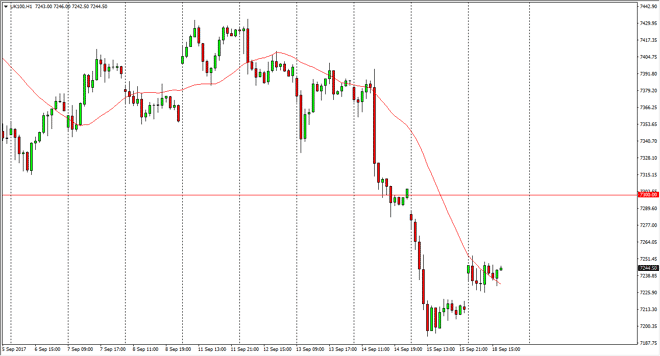

FTSE 100 Price Forecast September 19, 2017, Technical Analysis

Updated: Sep 19, 2017, 05:56 GMT+00:00

The FTSE 100 gapped higher at the open on Monday, and has since done essentially nothing. I believe that the 7300 level above is the initial target,

The FTSE 100 gapped higher at the open on Monday, and has since done essentially nothing. I believe that the 7300 level above is the initial target, mainly because of the gap that has not been filled from Friday. If we can break above 7325, then I feel that the market can continue to go much higher. The 7200 level looks to be very supportive, and I think that a pullback towards that area will probably find buyers. The FTSE 100 has sold off rather drastically, but this is mainly due to the looming threat of interest rate hikes coming out of the Bank of England. Nonetheless, that’s not necessarily going to be about the long-term, and therefore I think that the FTSE still has a bright future ahead of it, but in the meantime, expect a lot of volatility as the market readjusts its expectations. If we were to break down below the 7200 level, I think at that point we will go looking towards the 7100 level which is much more significant on the longer-term charts.

Currently, the market seems to be moving in the opposite direction of the GBP/USD pair, so keep in mind that the currency markets will probably be the leading indicator as to what happens in the FTSE 100. The GBP/USD pair has been testing a major resistance barrier above, so we may see a bit of a relief rally in this market. If we were to break above the 7325 handle, at that point I would anticipate that the market should then go to the 7400 level above, which is where the massive selloff started. Either way, I think that the volatility will be a mainstay of this market going forward, as there is so much in the way of questions out there.

FTSE 100 Video 19.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement