Advertisement

Advertisement

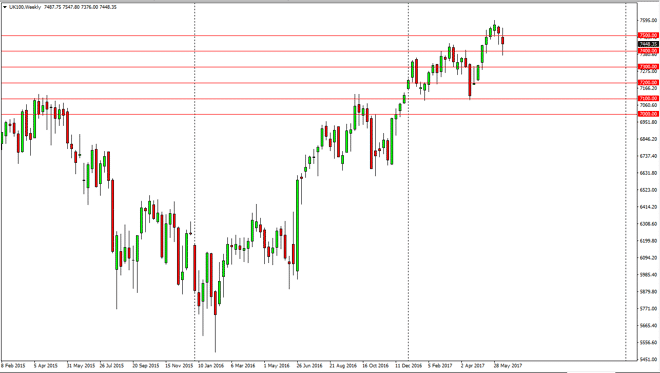

FTSE 100 Price forecast for the week of June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:15 GMT+00:00

The FTSE 100 went back and forth during the course of the week, testing the cell the 7400 level, and then breaking above the 7500 level. Ultimately, we

The FTSE 100 went back and forth during the course of the week, testing the cell the 7400 level, and then breaking above the 7500 level. Ultimately, we ended up forming a slightly negative candle. I still believe that the 7400 level underneath is massively supportive, as it was previously resistive. This is classic technical analysis, and I believe that the market is only trying to build up enough momentum to keep the longer-term uptrend intact. If you can trade with a small enough position, you should be able to deal with any type of short-term volatility that we may see in this general vicinity. Obviously, a fresh, new high is a very bullish sign and will more than likely send buyers back into this market. The market looks likely to be choppy to say the least.

Political headwinds

I think that there is a lot of political headwinds out there, and with this being the case the market will more than likely be volatile, but longer-term we are in an uptrend, and although there are a certain amount of potential headlines that could rock the market, I believe that the longer-term softness in the British pound will continue to make traders look at this as a market that can be bought due to exports being so strong. I believe that the best thing you can do is follow the trend anyway, so buying is the only thing I will do. The 7400 level underneath could be massively supportive as far as I can see, so having said that I think that the buyers will be attracted to the market going forward. Selling is not an option as far as I can see anytime soon in this type of environment.

FTSE 100 Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement