Advertisement

Advertisement

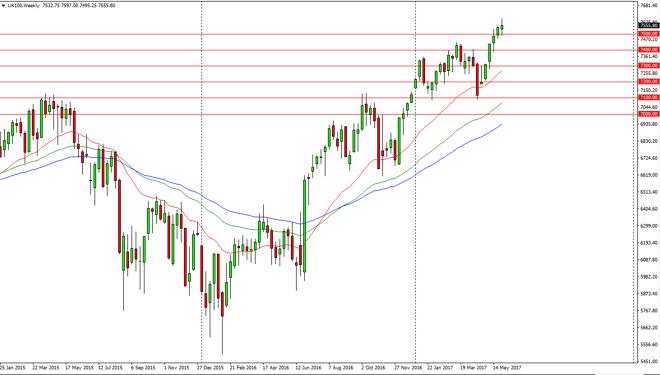

FTSE 100 Price Forecast for the Week of June 5, 2017, Technical Analysis

Updated: Jun 4, 2017, 10:56 GMT+00:00

The FTSE 100 had a volatile week, initially reaching down towards the 7500 level, and then bouncing off of them to gain again. I believe that the market

The FTSE 100 had a volatile week, initially reaching down towards the 7500 level, and then bouncing off of them to gain again. I believe that the market retains is bullish attitude, and therefore I have no interest in shorting. I believe that a pullback should find plenty of buyers, especially down at the 7400 level. Longer-term, I anticipate that the market will probably go looking for the 8000 level but it may take some time to get there. Either way, pullbacks offer value that I plan on taking advantage of as the British index continues to look very healthy.

The British pound of course is historically cheap at the moment, and that is part of what’s driving the FTSE 100 higher, the concept of cheaper exports. As the British pound gains in value, that could put a little bit of a headwind in the way of this market, but the likelihood of this turning the trend around is very slim.

Continued volatility

I believe that the continued volatility in this market is all but a foregone conclusion. This is because of all things involving the United Kingdom leaving the European Union, and all the headlines that could come out during this process. With this being the case, I look at pullbacks as blessings in disguise, and another opportunity to get involved to the upside. It is not until we break down below the 7200 level that I even begin to entertain the idea of shorting this market, something that does not look very likely to happen anytime soon. Because of this, I continue to believe in the FTSE 100 going forward, and think that longer-term money is not only involved at the moment, but probably hanging onto its positions.

FTSE 100 Video 05.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement