Advertisement

Advertisement

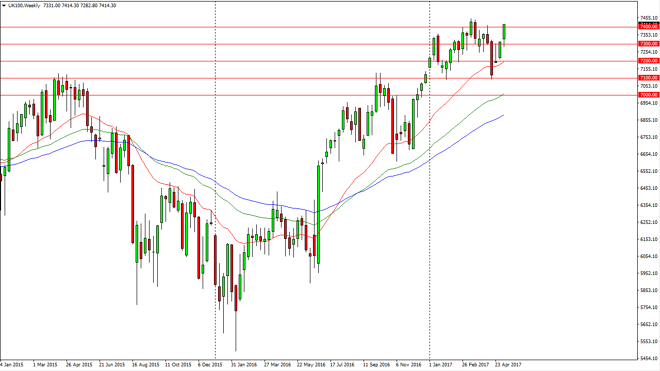

FTSE 100 price forecast for the week of May 15, 2017, Technical Analysis

Updated: May 13, 2017, 05:32 GMT+00:00

The FTSE 100 initially fell during the week but found enough support at the 7300 level underneath, and shot much higher. In fact, we ended up forming a

The FTSE 100 initially fell during the week but found enough support at the 7300 level underneath, and shot much higher. In fact, we ended up forming a very bullish candle that broke above the 7400 level and then close towards the very top of the range. Ultimately, I believe that this market is ready to break out to the upside and therefore buying is about the only thing you can do. Pullbacks on short-term charts should continue to act as triggers for value hunters. I believe that the 7300 level underneath will be a bit of a “floor” in the market, and that we have pulled back enough to attract value hunters. I recognize that the 7500 level above will be not only a target but a barrier, but I think that we will eventually break above there as well.

Bullish pressure continues

I see nothing on this chart that would make me sell the market, and I believe that the FTSE 100 will continue to gain momentum as we have not only seen bullish pressure, but it has been and a nice gradual pace, the exact type of move that longer-term investors prefer. Once we break above the 7500 level, I think that the market will then eventually try to go to the 8000 handle, but that of course will take some time. Pay attention to the British pound, it of course has an effect on this market as well, but more than likely that traders are looking at value with the British companies “on the cheap”, as foreign investors continue to pile into the FTSE 100 overall. This being the case, I believe that fighting the trend is folly and I choose not to anytime soon.

FTSE 100 Video 15.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement