Advertisement

Advertisement

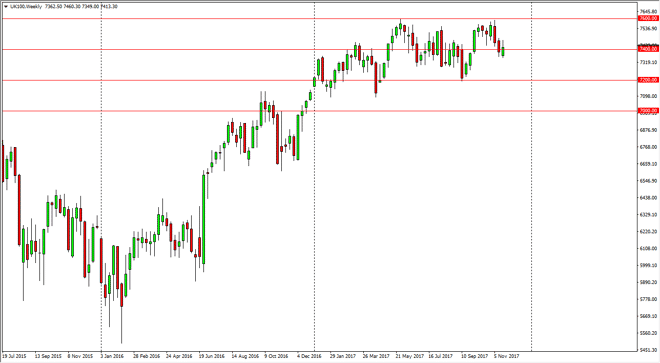

FTSE 100 Price forecast for the week of November 27, 2017, Technical Analysis

Updated: Nov 25, 2017, 05:22 GMT+00:00

The FTSE 100 gapped lower at the beginning of the week, but then turned around to break much higher. We started to see resistance above the 7400 level,

The FTSE 100 gapped lower at the beginning of the week, but then turned around to break much higher. We started to see resistance above the 7400 level, and as you can see we gave back some of the gains. A break above the top of the range for the week should send this market looking towards the 7600 level above, which of course is significant resistance. A break above there should send this market towards the 8000-level based upon the 4000-point consolidation range that we have been in for most of the year. We have a slight upward tilt, so it looks as if the market should continue to go higher, if you can handle the choppiness and volatility. The 7200-level underneath should be the “floor” in the market, and if we can stay above there I think that the buyers have the upper hand. However, a breakdown below there would of course be a very negative sign.

Looking forward, the headlines coming out of the negotiations between London and Brussels will of course have an effect on the FTSE 100, as exports could come into play. Also, keep in mind that the British pound could have an influence as well, either making British exports more expensive, or cheaper. The cheaper that the exports are, the better off the FTSE 100 tends to do. Nonetheless, I do believe in the longer-term uptrend based upon the technical analysis, it’s just that it won’t necessarily be an explosive moved, but more like a longer-term investment for those of you who are more in the “buy-and-hold” camp. A breakdown below the 7000 level ins the uptrend from what I can see, and would call for a much more significant pullback.

FTSE 100 Video 27.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement