Advertisement

Advertisement

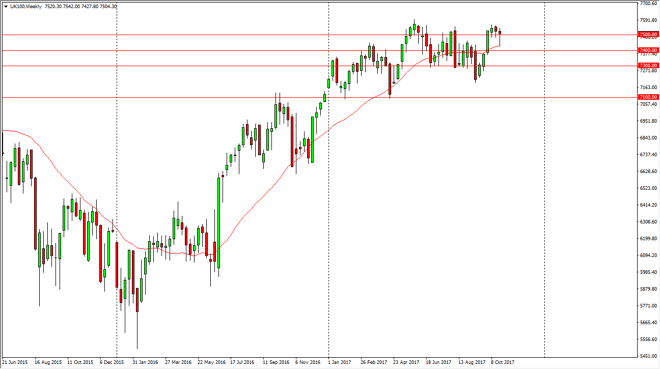

FTSE 100 Price forecast for the week of October 30, 2017, Technical Analysis

Updated: Oct 28, 2017, 11:52 GMT+00:00

The FTSE 100 fell during most of the week, breaking well below the 7450 handle, before turning around and bouncing enough to rally above the 7500 level.

The FTSE 100 fell during most of the week, breaking well below the 7450 handle, before turning around and bouncing enough to rally above the 7500 level. The resulting candle is a hammer, which of course is very bullish. This hammer sitting at the top of an uptrend tells me that the market is still trying to build up enough momentum to continue going to the upside. Ultimately, the market will probably reach towards the 7750 level, which has been my longer-term target for some time now. A part of the driver of course would be the British pound falling in value, which helps with exports coming out of London and the rest of the United Kingdom. A break above the top of the weekly candle would be a very bullish sign, and the market could really start to take off from there. Ultimately, I believe that pullbacks offer value, and it’s not until we break down below the 7300 level that I would be concerned about the uptrend.

Overall, we are in a stronger uptrend, and recently the consolidation has been necessary for what I can see. Quite frankly we continue to see the buyers come in every time we dip, and the general trend has been bullish enough that we have needed to calm down and build up the momentum to continue going higher. The market should continue to reach the upside, and I think that every time we pull back, there will be value hunters coming into the marketplace. I think that the longer-term uptrend is very much intact, as you can see by the moving average on the chart starting to turn higher yet again. The volatility continues, but for the longer-term trader, this presents an opportunity.

FTSE 100 Video 30.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement