Advertisement

Advertisement

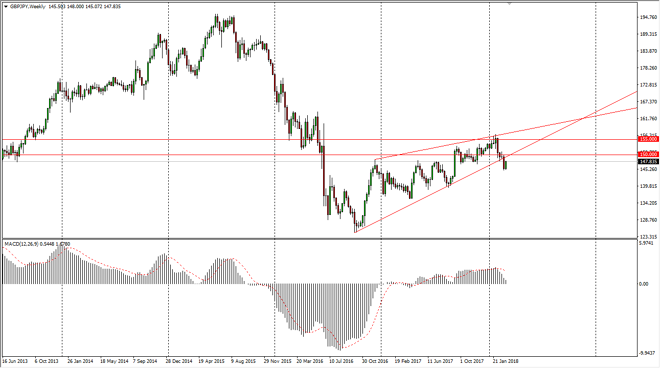

GBP/JPY Price forecast for the week of March 12, 2018, Technical Analysis

Updated: Mar 10, 2018, 06:58 GMT+00:00

The British pound rallied during the week, bouncing from the 145 region. However, there is a bit of an uptrend line that we broke down below during the previous week, so I would anticipate there could be a bit of resistance just above. In fact, the longer-term trader is probably going to need to wait until we get above the 150 handle to start buying again. Otherwise, we may see a selling opportunity.

The British pound rallied significantly during the week, reaching towards the 148 handle by the time Friday rolled around. However, the previous uptrend line sits just above, and it could be massive resistance. Beyond that, the 150 level offers resistance also. If we can break above the 150 handle, then the market could go to the 155 level. Signs of exhaustion in this area will be a selling opportunity, and I think that fresh money would come into the market start shorting again.

With the possibility of a trade war, we could see a bit of a “risk off” move in equity markets as well as commodity markets, and if that does come to fruition, it’s likely that this pair will roll over, perhaps reaching towards the 140 handle. I anticipate that there will be a lot of volatility in general, but I think that the longer-term trader will need to be patient to wait for some type of certainty coming into the market, giving us an opportunity to take advantage of the longer-term move.

I think the one thing you can count on is a significant amount of volatility, so waiting for one of these areas to get broken is going to be crucial. I think that short-term traders will continue to love this type of action, but longer-term traders may be put off.

GBP/JPY Video 12.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement