Advertisement

Advertisement

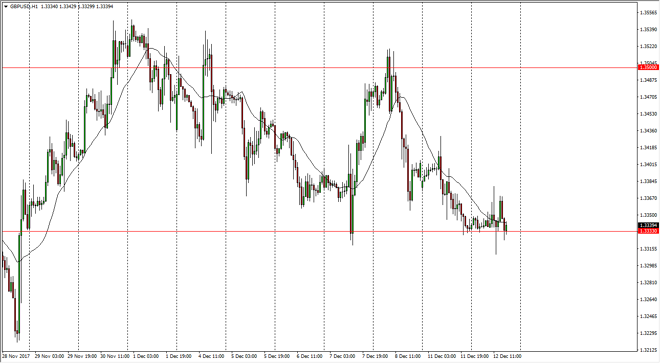

GBP/USD Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:11 GMT+00:00

The British pound was a volatile during the trading session on Tuesday, bouncing around the 1.3333 handle. Ultimately, this is a market that finds this area interesting, but with the Federal Reserve coming out with an announcement today, it’ll be interesting to see where we end up.

The British pound was choppy and volatile during the trading session on Tuesday, and tested the 1.3333 handle more than once. I think that we will continue to consolidate, but if we do break down from here, there is a significant amount of support at the 1.32 handle underneath. I believe that if we were to turn around and break above the 1.34 handle, then the market is ready to go to the 1.35 handle after that. I believe that this market continues to be very choppy and noisy in general, and with this being the case it’s likely that we continue to be cautious in this market place, at least until the Federal Reserve comes out with an announcement. We will see whether the Federal Reserve looks likely to raise interest rates going forward, and if it does, that could change the overall pattern of this trading pair. If they are dovish, that will send this market right back around and the buyers will flood into the pair, pushing it to the upside.

A breakdown from here should continue to attract more trading capital, but I still think that the uptrend line below that coincides with roughly 1.31 will be the “floor” in the market. A breakdown below there has the entire marketplace rolling over. The longer-term target for me is the 1.3650 level, which was a gap from a major move lower, but we need to get the Federal Reserve announcement out of the way to see where the US dollar should go, which of course is half of the equation.

GBP/USD Video 13.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement