Advertisement

Advertisement

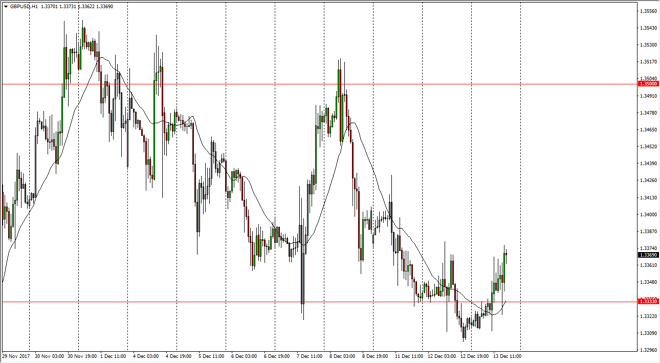

GBP/USD Price Forecast December 14, 2017, Technical Analysis

Updated: Dec 14, 2017, 05:58 GMT+00:00

The British pound has been very noisy over the last several sessions, but it looks as if we are trying to form a bit of a rounded bottom, and after the Federal Reserve releases its statement, we could see the market power much higher if there is a dovish surprise. Of course, the exact opposite could be true as well.

The British pound has been very noisy over the last several months, as we have negotiated a break away from the European Union. The 1.3333 handle has been very important, and as I await the Federal Reserve statement, is very likely that this level and of course this session, could cause the next move just waiting to happen. If we can break out to the upside, it’s likely that we could go to the 1.35 handle above. In general, I believe that the British pound is trying to form some type of uptrend longer-term, and with the recent higher than expected inflation coming out of the United Kingdom, we could see the Bank of England raise rates again.

However, in the short term it’s all about the US dollar, so we will have to see whether the Federal Reserve is more hawkish or dovish than anticipated. If there’s no surprise, then I think we can focus on Great Britain again. Otherwise, this will be about the US dollar and where it goes overall. If we break down below the 1.33 handle, then the market should go down to the 1.31 handle next. Otherwise, if we can break above the 1.34 handle, the market goes looking for the 1.35 handle, and then eventually the important 1.3650 level after that. Either way, it’s good to be volatile so keep your position size small, and await the daily close to tell you which direction the market is trying to go.

GBP/USD Video 14.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement