Advertisement

Advertisement

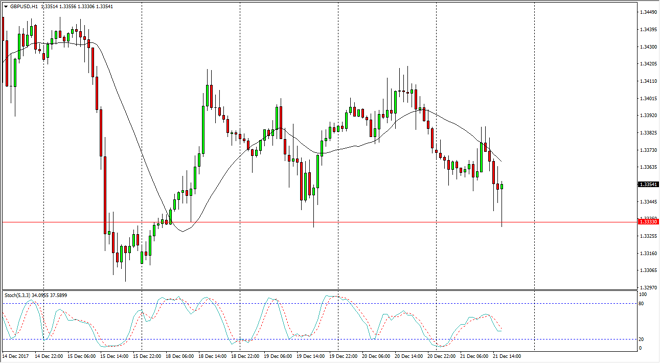

GBP/USD Price Forecast December 22, 2017, Technical Analysis

Updated: Dec 22, 2017, 05:45 GMT+00:00

The British pound has been slightly negative during the trading session on Thursday, but has found support exactly where you would need to see it if you are bullish.

The British pound has been very choppy over the last 24 hours, reaching down towards the 1.3333 handle, which is an area that I continue to mention as it is important. This is an area that was previously resistive, but now it looks likely that it should be supportive. By forming a hammer on the hourly chart, it looks likely that a bounce is about to happen, perhaps sending the British pound back towards the 1.34 level above. A clearance of that level should send this market looking for the 1.35 handle next. I also recognize that we could move in the other direction, and a breakdown below the 1.33 handle has this market looking towards the 1.31 handle underneath which is going to be support. That is an area that I think is vital as it coincides with a nice uptrend line, so obviously we need to see those areas hold in general. I think this will end up being a buying opportunity before it’s all said and done though, especially considering that US GDP missed slightly during the day.

I also believe that historically cheap British pound pricing is going to be something that people are paying attention to as well. Longer-term traders are looking at this as an opportunity to pick up the Pound on the cheap, and will course slowly and to a larger position. As the fallout from the United Kingdom leaving the European Union dissipates a bit, I believe the people will become much more comfortable owning the British pound, and it should rally from here. I believe 2018 is going to be where we see buyers jump back in.

GBP/USD Video 22.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement