Advertisement

Advertisement

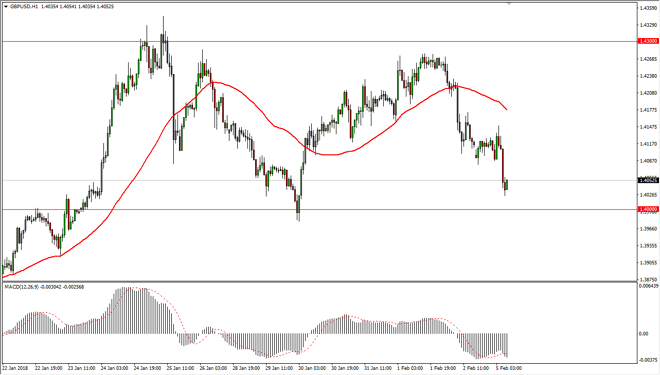

GBP/USD Price Forecast February 6, 2018, Technical Analysis

Updated: Feb 6, 2018, 05:20 GMT+00:00

The British pound went sideways initially during the trading session on Monday, but then fell towards the vital 1.40 level. That is an area that has offered support recently, just as it has offered resistance. I believe that the market should continue to find this area important, so paying attention to this market today is paramount.

The British pound went sideways during the trading session on Monday, but then broke down significantly to reach towards the 1.40 level underneath. It’s likely that the market will have a reaction to touching this level, as it is a large, round, psychologically significant level. We have seen the market bounce from there just a few days ago, so it’s possible we may see consolidation going forward. If we can bounce from the 1.40 level, we could find the market trying to go back towards the 1.43 level again. On the other hand, if we break down below the 1.40 level, the market probably goes looking towards the 1.39 level next, which I see as the bottom of the support “zone” that starts at the 1.40 level.

Expect volatility, but longer-term I do believe that the British pound will continue to do quite well. It is oversold from a historical point of view and has been in an uptrend for some time. We are in short term consolidation, but this is typically an opportunity to accumulate British pounds, not sell them.

The markets will continue to be very choppy, mainly because of the negotiation between the European Union and the United Kingdom, which of course will produce headlines occasionally that could move the markets and very violent manners. Ultimately, it looks as if the market is trying to turn towards the upside based upon the last year, but any time you get a trend change, it tends to be very noisy.

GBP/USD Video 06.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement