Advertisement

Advertisement

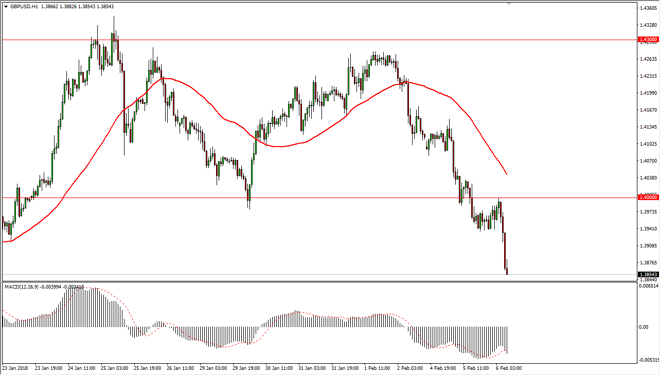

GBP/USD Price Forecast February 7, 2018, Technical Analysis

Updated: Feb 7, 2018, 04:49 GMT+00:00

The British pound has fallen apart during the trading session on Tuesday, as the 1.40 level now acts as resistance. However, I still believe in the longer-term story but as we continue to have a bit of a “risk off” attitude in the global markets, that should continue to be a difficult for British pound bulls.

The British pound has initially tried to break above the 1.40 level, but failed to get above there, and then rolled over towards the 1.3850 level. It looks likely that the market will continue to go lower, perhaps reaching down to the 1.38 level after that. I expect volatility to continue to be an issue, at least until the global stock markets start to show signs of stabilization. If they do, then I would fully anticipate that this market should rally a bit, but we have been a bit over exuberant when it comes to risk appetite lately, so it makes sense that we are getting a stringent pullback.

While I suspect that this market will continue to go lower, I would not be a seller at this point, this is because I look at the longer-term charts and recognize that we have had a major breakout to the upside, and that there are plenty of support levels underneath. I believe that being patient with this market is probably the best way to deal with it, or perhaps go long the EUR/GBP pair.

Ultimately, I believe that the market should continue to be noisy to say the least, and the US dollar is going to cause major issues, as the US Dollar Index has tested a major bottom. That could continue to put downward pressure in the short term, but I believe that structurally we are going to see the US dollar we can as we go later into the year. Because of this, I’m waiting for an opportunity to start buying.

GBP/USD Video 07.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement