Advertisement

Advertisement

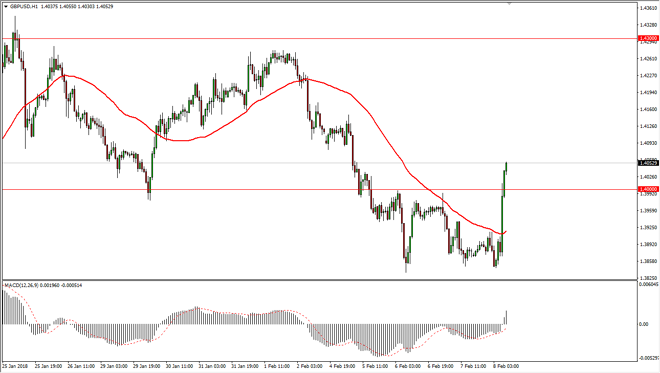

GBP/USD Price Forecast February 9, 2018, Technical Analysis

Updated: Feb 9, 2018, 05:26 GMT+00:00

The British pound has exploded to the upside during trading on Thursday, cleaning the vital 1.40 level. By showing such strength, it’s likely that we will continue to see some momentum.

The British pound has exploded higher during trading on Thursday, as we got through the interest rate hike without a scratch. It looks as if breaking above the 1.40 level should send this market higher, a level that I have been paying attention to recently. Is a large, round, psychologically important level, and of course the scene of previous resistance. Now that we are clear this area, I suspect that people will be coming in to pick up dips as value.

The 1.43 level above will more than likely be targeted, as it was resistance in the past. Pay attention to the US Dollar Index, because it starts falling that should put bullish pressure in this market as well. The US dollar has rallied a bit as of late, but quite frankly that was a short-term move from what I saw. I think that the market should continue to be very volatile, but I think that we will continue to prefer selling the US dollar in general, so that should continue to offer a bit of a boost to currency such as the British pound.

Remember, this is somewhat wrist sensitive, so we need to see stock markets performed reasonably well to help along. The market should continue to look for value in other currencies beyond the greenback, as the global expansion continues. The British pound will continue to benefit from a lack of Armageddon suddenly appearing after leaving the European Union. While the negotiations are still going on, it has become clear that cooler heads have prevailed over the last couple of months.

GBP/USD Video 09.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement