Advertisement

Advertisement

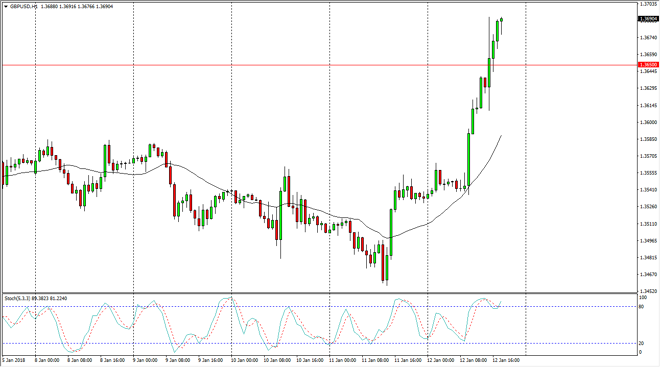

GBP/USD Price Forecast January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 02:54 GMT+00:00

The British pound exploded to the upside during the trading session on Friday, as we ate finally sliced through the 1.3650 level, an area which is the gap from the vote to leave the European Union. Because of this, it’s likely that the market has entered a new phase.

The British pound has exploded to the upside, slicing through the 1.3650 level. That’s an area that was important due to the vote to leave the European Union and the resulting gap, and that shows that we have seen an extreme amount of bullish pressure jump into the fray. Because of that, I believe that this is starting to become more of a “buy-and-hold” market, as we are more than likely going to go looking towards the 1.45 level above. This wipes out the gap from the vote to leave, and that is a very significant turn of events.

At this point, I believe that pullbacks are buying opportunities, and that the 1.3650 level will probably be a bit of a floor, although a soft one. I think that there are plenty of reasons to think that this market continues, as the US dollar has been getting pummeled against almost everything. The British pound has been oversold for some time, and now that the markets are getting over the shock of the United Kingdom leaving the European Union, it makes sense that we see more believe in the pound, expressed by the purchasing of the market. The 1.40 level is the next obvious target, but I think at this point we will probably break above there and eventually go to the 1.4250 level, and then longer-term the previously mentioned 1.45 handle. This will take several months in my estimation, but certainly it seems that buying is the only thing possible.

GBP/USD Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement