Advertisement

Advertisement

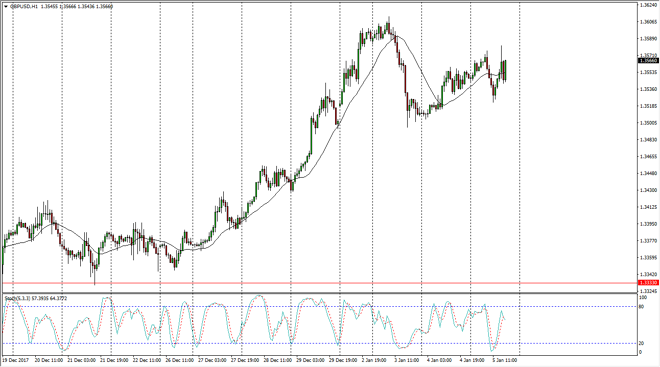

GBP/USD Price Forecast January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:44 GMT+00:00

The British pound initially rally during the trading session on Friday, but then dipped. Later, after the jobs number came out the Americans bid the pair back to the upside.

The British pound was volatile during the Friday session, initially tried to rally, but then pulled back towards the 1.35 handle. Americans bought this pair as the jobs numbers missed in the United States, so therefore it looks as if we are going to end up forming a supportive looking candle for the daily timeframe. The 1.3650 level above continues to be massively resistive, so it’s going to take a significant amount of momentum to finally break out. Once we do though, this is a market that continues to reach to the upside, perhaps the 1.40 level initially, followed very shortly by the “buy-and-hold” market.

The 1.35 level underneath should continue to offer plenty of support, and I think at this point you must look at it as a short-term floor. If we break down below there, then fine, we will probably go looking towards the 1.3333 handle again for support. I fully anticipate that the level will hold the trend to the upside, based not only by the structural support of the horizontal level, but also the uptrend line on the charts. I am bullish of the British pound, and I believe that the US dollar is going to continue to be very difficult to keep afloat, as it looks very vulnerable to most currencies around the world, with of course the British pound being much the same. Once we break the 1.3650 level, I think that the market will start to pick up momentum, and I would become much more aggressive above that level. Until then, I would add slowly on dips.

GBP/USD Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement