Advertisement

Advertisement

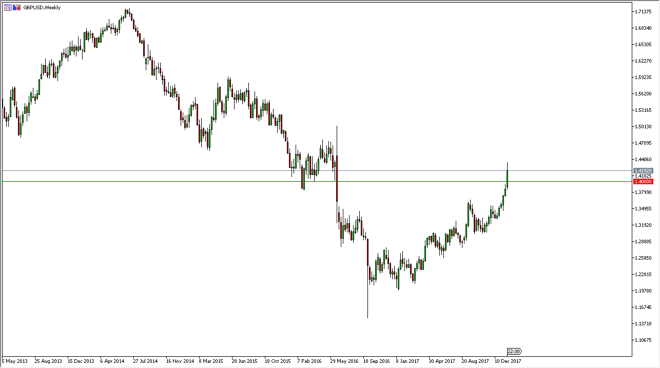

GBP/USD Price Forecast for the week of January 29, 2018 Technical Analysis

Updated: Jan 27, 2018, 05:44 GMT+00:00

The British pound has gapped higher at the open of the week, and then broke above the 1.40 level. That’s a very bullish sign, although we have run into a bit of trouble at the 1.42 level. Longer-term though, looks like we are trying to make a statement.

The British pound has rallied significantly during the week, breaking above the 1.40 level. This is a very bullish sign, and I think that the market will eventually go looking towards the 1.50 level. There is a lot of noise just above though, so expect a lot of volatility. I think a short-term pullback is probably necessary, but I would anticipate the 1.40 level to be supportive enough to continue to push this market to the upside. We are bit overextended, so this pullback should be healthy for the overall trend. If we break down below the 1.39 level, then I think the market goes much lower, and perhaps reach towards the 1.35 level underneath.

The US dollar is extraordinarily weak currently, and it’s likely that we will continue to see that reflected in this market. The death of the British economy and the United Kingdom was a bit prematurely announced, and I think that’s what we’re seeing right now. If the United Kingdom gets a fair deal out of the negotiations with the European Union, I anticipate that the British pound will continue to show strength, and perhaps reach towards the highs that we had seen a few years ago. Alternately, if they get a poor deal, that will more than likely send the British pound much lower. Expect a lot of noise, but unless something changes drastically around the world, it’s likely that we will see buyers attracted to pullbacks as it represents value.

GBP/USD Video 29.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement