Advertisement

Advertisement

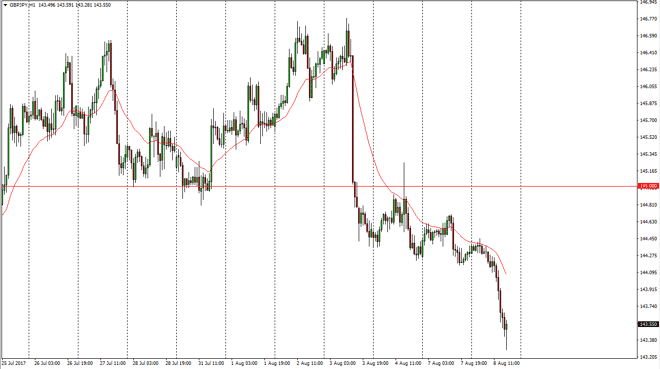

GBP/JPY Forecast August 9, 2017, Technical Analysis

Updated: Aug 9, 2017, 05:04 GMT+00:00

The British pound fell rather significantly during the day, especially against the Japanese yen. By breaking down below the 144 handle, the market looked

The British pound fell rather significantly during the day, especially against the Japanese yen. By breaking down below the 144 handle, the market looked towards the 1.40 3.50 level underneath. We bounced enough to suggest that we are going to see sellers jumping into this market, at higher levels. I have no interest in buying this market, I believe that the sellers should continue to jump in. The 145 level above should be a significant barrier to overcome, so it’s not until we break above there that I would be comfortable buying in the short term. I think that the market is probably going to go looking for lower levels, as the British pound continues to soften.

Pay attention to GBP/USD

The GBP/USD pair will be crucial in determining where this market goes next, and if we can stay below the 1.30 level, that should translate into lower pricing over here. Alternately, if the GBP/USD pair breaks above the 1.3050 level, that should translate to this market going higher. Ultimately, I think you’re looking at a lot of volatility, so I believe that you will have to be very careful in this market, and I suppose that we should be looking at short-term moves in smaller increments as it gives us a bit of safety in what is typically a very volatile market.

GBP/JPY Video 09.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement