Advertisement

Advertisement

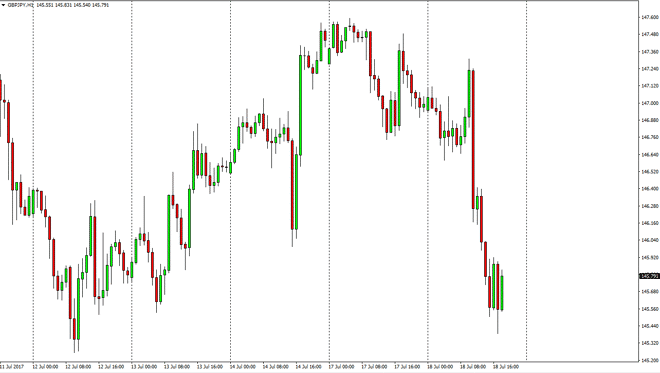

GBP/JPY Forecast July 19, 2017, Technical Analysis

Updated: Jul 19, 2017, 05:56 GMT+00:00

The GBP/JPY pair went sideways initially during the day on Tuesday, but fell apart as CPI numbers coming out of the United Kingdom were less than

The GBP/JPY pair went sideways initially during the day on Tuesday, but fell apart as CPI numbers coming out of the United Kingdom were less than expected. This shows a lack of urgency when it comes to raising interest rates in the United Kingdom, and of course works against the British pound overall. However, I think that this was a bit overdone, and I believe that the biggest driver of this market might be the GBP/USD pair. If we can stay above the 1.30 level in that market, I think that there is the likelihood that we are going to bounce in this market. Quite frankly, we have seen a significant amount of support near the 145 handle, so I think that it is a return to the bottom of consolidation. It’ll be an interesting trade to take, but obviously it will be very choppy. Pay attention to the British pound against the US dollar, that is the benchmark as to where they measure British pound strength. If it rises, this pair does as well.

The alternate scenario

The alternate scenario is a breakdown below the 145 handle, which would be very negative for this pair, perhaps sending it down to the 142.50 level. I believe that it’s less likely to happen than a bounce, so I think that the market will continue to find buyers, and it is only a matter of time before we reach back towards the 147.50 level again. That’s not to say is going to be easy, and that’s not to say that it will be quick, but I do believe that there is a likelihood that the buyers should return based upon not only historical movement, but the fact that the Japanese yen is so soft.

GBP/JPY Video 19.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement