Advertisement

Advertisement

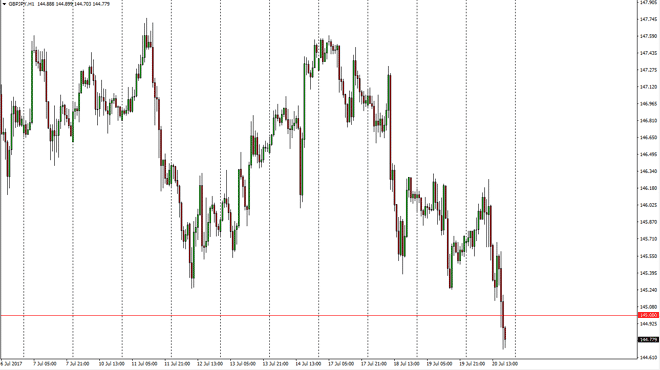

GBP/JPY Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:27 GMT+00:00

The GBP/JPY pair initially tried to rally during the day on Thursday but found enough resistance just above the 146 handle to sliced through the 145

The GBP/JPY pair initially tried to rally during the day on Thursday but found enough resistance just above the 146 handle to sliced through the 145 handle. The daily close is going to be very important, and if we can break down below the 144.50 level, the market could drop significantly, perhaps reaching down to the 142.50 level next. Alternately, if we can bounce above the 145 handle, we could reach towards the 146 level in the short term. This pair is very volatile, and very sensitive to risk appetite overall. The British pound got sold off against most other currencies around the world, so it’s not a surprise that we sell this market slice to the downside. On top of that, the USD/JPY pair broke down, and that knock on effect of course saw this market drop.

Watch the GBP/USD

You should pay attention to the GBP/USD pair, because it will dictate what happens with the British pound overall. As I write this, it appears that we are starting to see a little bit of support just below the 145 handle, so a bounce could happen. However, the GBP/USD pair needs to hold as well, but the two do simultaneously, that could be a very significant sign for where the market goes next. The choppiness should continue, but being patient is probably going to be the best thing you can do with this market as it’s difficult to suggest that jumping in with both feet would be prudent.

GBP/JPY Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement