Advertisement

Advertisement

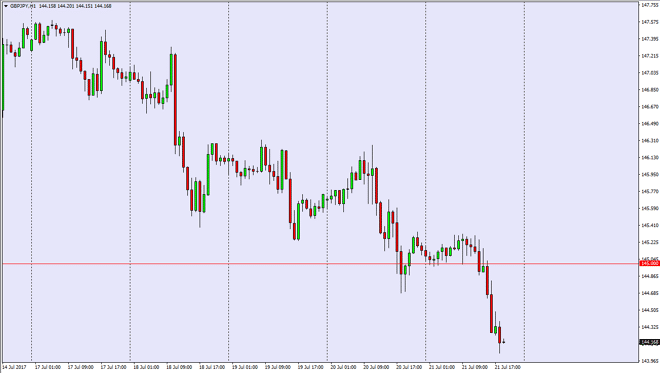

GBP/JPY Forecast July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:02 GMT+00:00

The British pound went sideways initially on Friday, hovering above the 145 handle. However, later in the day we break down below that level and reached

The British pound went sideways initially on Friday, hovering above the 145 handle. However, later in the day we break down below that level and reached towards the 144 level. The market looks very bearish, and based upon longer-term charts I believe that we have farther to go. Nonetheless, I think that it will be somewhat limited, so I believe that the next couple of sessions might be bearish in general, but I don’t think it goes much longer than that. Market participants continue to fear the British pound in general, and I think that has more to do with this than anything else. There are a lot of headlines coming out of the negotiations with the European Union that of course can cause volatility, but given enough time I think that this market will bounce. In the short term, I believe in selling rallies, because quite frankly this is a market that should continue to find volatility to be the name of the game.

If we can break above 145.25

If we can break above the 145.25 handle, the market should continue to go much higher. That being the case, if we break out to the upside I believe that buying dips will be the way going forward, as we should continue the bullish pressure that we have seen on longer-term charts. I think that given enough time we should continue to see the market reach towards the 148.50 handle. A break above there then has the market going to the 150 handle. Alternately, if we do continue to break down, I believe that the market should then go down to the 142.50 level. That’s an area where I expect to see a significant amount of support, and therefore I think that the longer-term buyers will jump back into this market.

GBP/JPY Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement