Advertisement

Advertisement

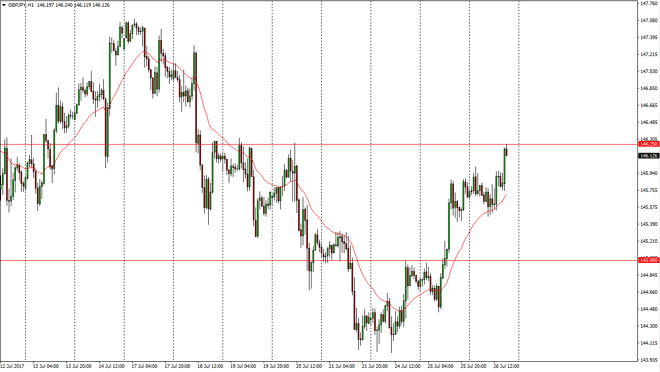

GBP/JPY Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:40 GMT+00:00

The British pound went sideways initially against the Japanese yen, but then broke out to the upside as we started to clear the 146.25 handle. It looks

The British pound went sideways initially against the Japanese yen, but then broke out to the upside as we started to clear the 146.25 handle. It looks like the market can go to the 146.75 handle rather quickly, and that perhaps even to the 147.5 handle above which has been massive resistance in the past. I believe in buying dips, because quite frankly the Japanese yen is starting to solve rather rapidly, and I believe that there is plenty of buying pressure underneath to continue the momentum against the Japanese yen and most of the currency pairs that I attract.

Buying dips

I continue to buy dips, and believe that selling is all but impossible at this point. I think that there is a significant amount of support near the 146 handle, and it’s not until we break down below the 145.50 level that I would consider selling. Because of this, I believe that we have more than enough reason to start not only buying this market, but adding small bits on dips that offer value. It won’t be a straight shot higher, but certainly it seems as if the buying pressure is starting to pick up. Ultimately, I believe that we reach the 147.50 level and beyond. With that in mind, I am extraordinarily bullish of this pair, as a continues to reward those who are patient enough to buy into it. If we can break above the 147.50 level, the market should continue to reach towards the 150 level, which is my longer-term target, but I expect that will take several months to reach that level. It will be easy, but if you are patient enough to continue buying on the dips, you should be rewarded in this currency pair.

GBP/JPY Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement