Advertisement

Advertisement

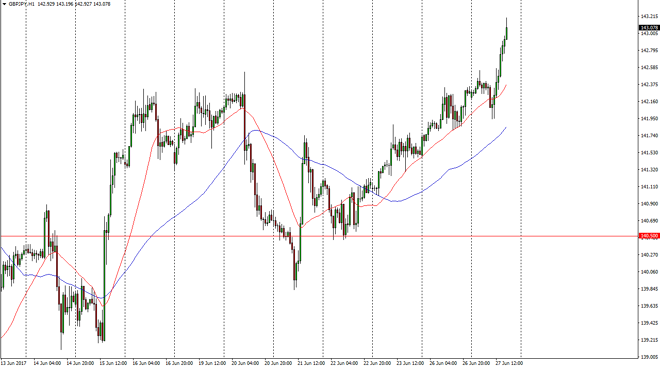

GBP/JPY Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:45 GMT+00:00

The GBP/JPY pair initially went sideways on Tuesday, pulled back slightly to reach towards the 142 handle, and then shot to the upside. The 143 level

The GBP/JPY pair initially went sideways on Tuesday, pulled back slightly to reach towards the 142 handle, and then shot to the upside. The 143 level being broken above is a bullish sign, and I believe that the market is now a market that is a buying opportunity. That move tells me that a pullback is value in a market that should continue to extend to the upside, as the Japanese yen has been selling off. Given enough time, we should then reach towards the 145 handle, which of course is a large, round, psychologically significant level. A break above there would of course be even more bullish, but I think at first, we can just look at that as the initial target. The 142.50 level should be supportive, and essentially the “floor” in this move if it continues to go higher.

Risk appetite

I believe that the GBP/JPY pair will continue to be volatile, but it has a lot to do with the risk appetite around the world. After all, the pair tends to react positively to strong stock markets and of course commodity markets. With this being the case, I think that if the stock markets around the world continue to rise, then that will give us plenty of reason to go long. On top of that, the British pound will react to the headlines coming out of London, when it comes to the divorce from the European Union. With this being the case, it’s likely that we will have a lot of motion in this market, and of course a lot of volatility due to random bits of news flash and across the wires. Regardless, I believe that the market has more upside than down, as today has been so bullish.

GBP/JPY Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement