Advertisement

Advertisement

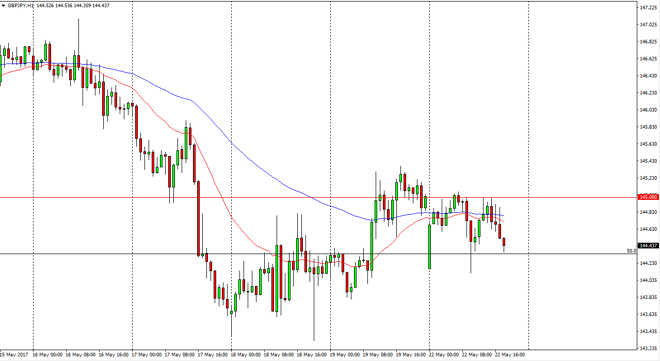

GBP/JPY Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:05 GMT+00:00

The GBP/JPY pair initially gapped lower, and then shot higher, reaching towards the 145 handle. The 145 level now looks to be massively resistive, so we

The GBP/JPY pair initially gapped lower, and then shot higher, reaching towards the 145 handle. The 145 level now looks to be massively resistive, so we can break above there I think that’s a very strong sign for this currency pair. There is a significant amount of support just below, so I do expect that it will hold over the longer term, and with that in mind I am looking for buying opportunities. Once we break above the 145 handle, the market should then go looking for the 146-handle next. A break above there sends us to the 147 handle.

Risk on/risk off

Remember that this pair is extraordinarily risk sensitive, so pay attention to the stock markets. If they go higher, typically this pair will as well. On the other hand, if they start to roll over typically this pair will roll over also. I believe that there is plenty of support below though, so I do prefer the upside given half a chance. If we break down below the 144 handle, the market should then go looking for the 143.50 level, which has been supportive. Somewhere between here and there I would anticipate that the buyers would come back in, as they would see plenty of support and value in a market that has been extraordinarily choppy.

This market of course will have some influence due to the United Kingdom leaving the European Union, and all the headlines coming out of that situation. Having said that though, it tends to follow the other yen related pairs more than anything else. With that being the case, pay attention to the USD/JPY pair to get an idea of where the Japanese yen is going to be going over the next several sessions.

GBP/JPY Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement