Advertisement

Advertisement

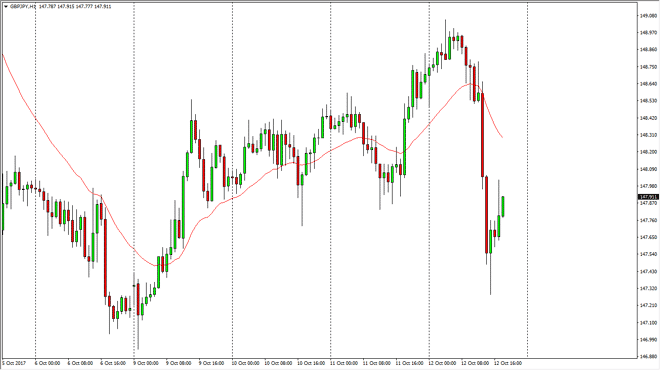

GBP/JPY Forecast October 13, 2017, Technical Analysis

Updated: Oct 13, 2017, 05:40 GMT+00:00

The British pound went sideways initially during the day on Thursday, but then fell apart against the Japanese pound, reaching towards the 147.50 level

The British pound went sideways initially during the day on Thursday, but then fell apart against the Japanese pound, reaching towards the 147.50 level below. There is a significant amount of support in this general vicinity, and we are starting to bounce. However, I think that the market should continue to be volatile as this pair tends to be rather sensitive to risk appetite, which of course is going to be all over the place. Ultimately, this is a market that should continue to be noisy, and with this being the case it’s likely that it will rise and fall with the overall trading attitude of the community at large. I think that the recent selloff during the day of course is rather negative, so it’s good to be difficult to hang onto any type of buying position. If we do continue to see bullish pressure, you could perhaps jump back in but I would do with a small position only.

Rallies that show signs of exhaustion could be selling opportunities as well, and I think that overall this market is stuck between the 147 level on the bottom, and the 150 level on the top. Because of this, the market should continue to be one that is probably best played from a range bound attitude, with the caveat that you only trade small positions as larger positions could be very damaging to your account. If we were to break above the 150 handle, then I would be willing to jump in much more forcefully. Until then, I think it’s very likely that the market will cause more pain than pleasure, as traders get thrown around rather violently. Thursday’s action was a perfect example, we were initially tried to rally, but then turned around and completely collapsed.

GBP/JPY Video 13.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement