Advertisement

Advertisement

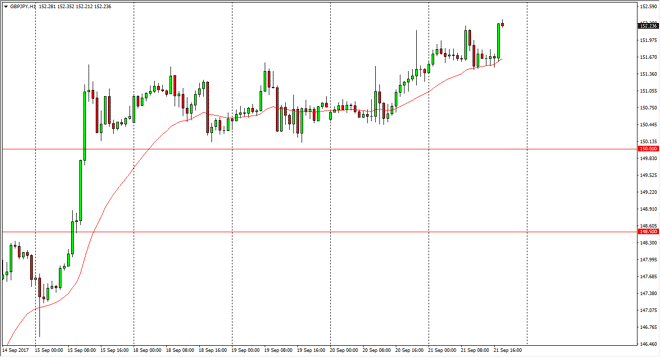

GBP/JPY Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:47 GMT+00:00

The GBP/JPY pair was choppy during the session on Thursday, but continues to show positivity in general. Because of this, I think that the longer-term

The GBP/JPY pair was choppy during the session on Thursday, but continues to show positivity in general. Because of this, I think that the longer-term uptrend is going to continue, especially with the bank of England looking very likely to raise interest rates. I think that the market will look at dips as buying opportunities and if the stock markets can remain reasonably stable, that should facilitate the “risk on” trade that helps this move higher. I believe that we will probably go looking towards the 155-handle given enough time, as the British pound is exploding to the upside and of course the Japanese yen is considered to be the “safe” currency in the equation. With the Bank of Japan looking very loose monetarily policy speaking, I think that this market should continue to find plenty of buyers on dips. Ultimately, I think the 155 handle is just the first target, and that we should probably go much higher than that.

I believe that the “floor” in the market is closer to the 150 handle, and if we can stay above there we should continue to grind our way much higher. The market should continue to find value every time we pull back, and it’s not until we break down below 150 that I would become remotely concerned about the uptrend. Even then, I think there’s plenty of support at the 140.50 level to keep the market in a bullish time. In fact, it’s not unless we get some type of massive “risk off” event that this pair will struggle. That being said, I am bullish, and I do recognize that value is to be had by hanging onto a bullish position. Adding on short-term dips is how I plan on tackling this market going forward.

GBP/JPY Video 22.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement