Advertisement

Advertisement

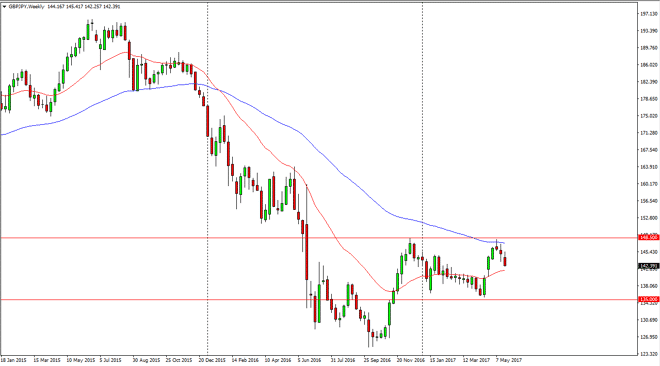

GBP/JPY forecast for the week of May 29, 2017, Technical Analysis

Updated: May 27, 2017, 05:01 GMT+00:00

The GBP/JPY pair rolled over during the week, as we initially tried to rally, and then found trouble at the 145.50 level. As we have seen this, the market

The GBP/JPY pair rolled over during the week, as we initially tried to rally, and then found trouble at the 145.50 level. As we have seen this, the market has rolled over and fell significantly. The market looks likely to continue to go lower, as the 135 level below will be supportive, as will the 140 handle. This pair is very sensitive to risk appetite in general, and it appears that there is a bit of a “risk off” bias now. That tends to work against the British pound when it comes to the Japanese yen as the Japanese yen is such a safe to currency. Alternately, the market is also seeing the British pound selloff in general, so that of course translates to lower prices over here.

Are we still in consolidation?

Looking at the chart on the weekly period, it looks as if we are trying to for some type of consolidation and if that’s the case, we probably will continue to go little bit lower. I do see a significant amount of potential support at the 140 level though, so that could also cause a bit of a bounce. Pay attention to the futures markets, as well as stock markets. If they start to fall, it’s likely that the market here will drop as people will be running to the general safety of the Japanese yen at that point. Either way, it’s going to be a volatile market, as it typically is. If we were to somehow turn around and break above the 148.50 level, we then it could continue to grind higher, perhaps as high as the 160 level. With the divorce proceedings from the European Union going on in London, there will continue to be volatility.

GBP/JPY Video 29.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement