Advertisement

Advertisement

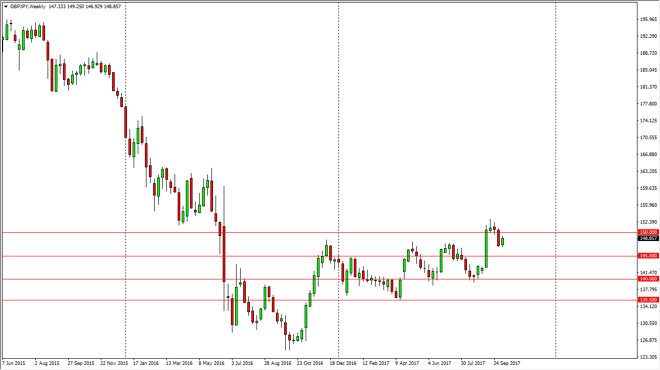

GBP/JPY forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:31 GMT+00:00

The British pound rallied against the Japanese yen during the week, as we continue to reach towards the 150 level again. A couple of weeks ago, we had

The British pound rallied against the Japanese yen during the week, as we continue to reach towards the 150 level again. A couple of weeks ago, we had formed a shooting star, and pulled back from the vital 150 handle. I think this continues to be an area of resistance, but if we can break above there I think that the market then can go to the 160 level, via the 155 handle. This is a market that is highly sensitive to risk appetite, so pay attention the stock markets, because it they go higher typically this market will continue to the upside. Ultimately, the British pound does have a bit more in the way of noise attached to it because of all of the political situations going on between London and Brussels, so this is a market that is going to be very noisy. I think that there is a bit of a “floor” near the 145 handle, so if we can stay above there, I don’t see the reason why we don’t get the breakout that’s needed.

The breakout isn’t going to be clean, it’s going to be very noisy. I think that being able to hang onto a smaller position and add to whatever the longer-term is probably the best way to go about this market. I think eventually, someday we will break above the 160 handle, then it becomes a much stronger uptrend. In the meantime, it continues to be a “buy on the dips” type of scenario, and perhaps an opportunity to add to your position happens every time that occurs. By staying small with your initial position and then adding as we go higher, you should be able to take advantage of the longer-term uptrend that is forming.

GBP/JPY Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement