Advertisement

Advertisement

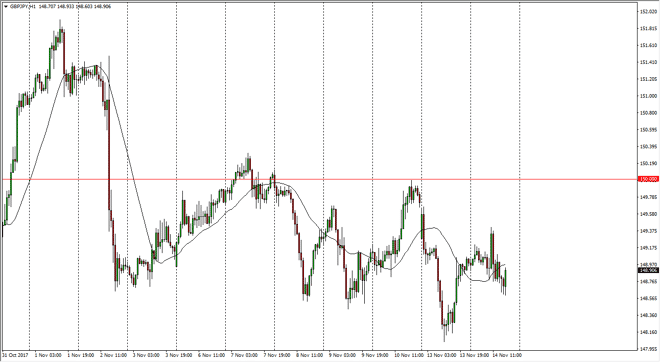

GBP/JPY Price Forecast November 15, 2017, Technical Analysis

Updated: Nov 15, 2017, 05:31 GMT+00:00

The British pound went sideways in general during the trading session on Tuesday, but continues to be very volatile to say the least. The 150 level above

The British pound went sideways in general during the trading session on Tuesday, but continues to be very volatile to say the least. The 150 level above is massively resistive, and I do not think that the market is ready to break out above there. However, I think that we are not necessarily going to see some type of melt down either. I suspect that we are going to roll over towards the 148 level, and a breakdown below there will probably send this market to the 147 level after that. A breakdown below the 147 level sends this market down to the 145 handle. The volatility should continue to be an issue, but if we get short-term rallies, exhaustion should be an opportunity to start selling again. However, if we were to break above the 150 handle, I would be more apt to start buying as it would be a very strong sign for the British pound. If this were to coincide with British pound strength against the US dollar, I would also continue to be bullish of this market at that point.

Overall, this is a market that should continue to be noisy, and I recognize that the volatility is going to make trading very dangerous. Keep your position size small, and operate with a range bound type of trading attitude, with a downward bias. This market could turn around at the drop of a dime though, as headlines tend to be main drivers of what happens next. A move above the 150 level could send this market looking towards the 152 handle, as it would show a major momentum shift. However, the breakdown, if it continues, will be slow and grinding more than anything else as we have seen over the last several sessions.

GBP/JPY Video 15.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement