Advertisement

Advertisement

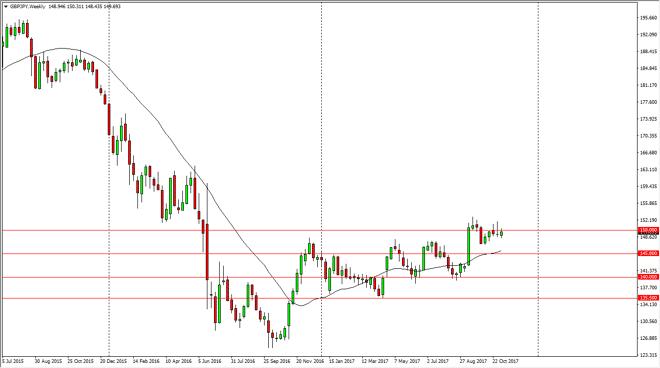

GBP/JPY Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:10 GMT+00:00

The British pound has rallied a bit during the past week against the Japanese yen but continues to struggle at the 150 handle. This is an area that has a

The British pound has rallied a bit during the past week against the Japanese yen but continues to struggle at the 150 handle. This is an area that has a significant amount of psychological resistance built into it, and the previous week of course formed a shooting star, which is obviously very negative candle. If we can break above that level, and more importantly the shooting star from the previous week, we could continue to go higher. However, this pair tends to need some type of “risk on” rally overall in global financial markets to continue to go higher over the longer term. In general, we have been rallying for much of the year, and some form of up trending channel. This of course is a very bullish sign, but it also leaves the door open to drop down to the 145 handle.

If we do eventually break out, the next obvious target would be the 155 handle, as it is a large, round, psychologically important figure. Beyond that, it is also an area that has offered both support and resistance going back 2 years ago. The likelihood of the market reaching that level is reasonably high, but we need to see the GBP/USD pair rally as well, as it is of course the measurement of the British pound strength in general. With this being the case, I suspect we are going to be stagnant for the next week or so, as the market must build up the necessary momentum to finally break out. If we do pull back, I think that the 145 level will hold significantly supportive action in the near term. If we were to break down below there, we could go down to the 140 handle, and then perhaps even break down below there.

GBP/JPY Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement