Advertisement

Advertisement

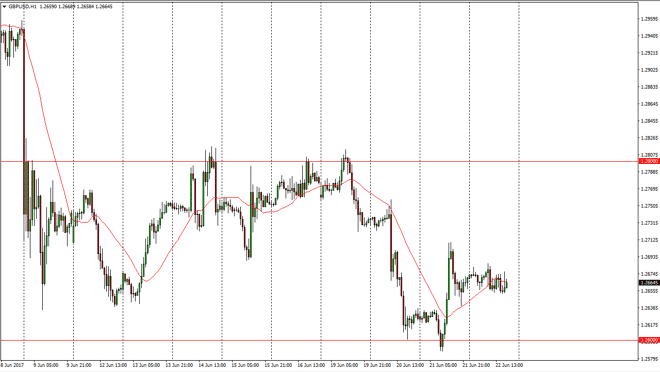

GBP/USD Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:40 GMT+00:00

The British pound had a sideways session on Thursday as we continue to hover just above the 1.2650 level. This is an area that has a certain amount of

The British pound had a sideways session on Thursday as we continue to hover just above the 1.2650 level. This is an area that has a certain amount of psychological support, but quite frankly the more important level as the 1.27 handle, and then eventually the 1.28 handle. A break above there since this market looking for the 1.30 level, but it’s going to take a while to get to that level. The 1.26 level underneath continues to offer support. Ultimately, the market should then find buyers on dips, because quite frankly the British pound has been oversold. However, if we make a fresh new low, then I think the market will probably go looking for the 1.25 handle which is a very important number.

Regardless what happens, it’s going to be noisy

With the United Kingdom leaving the European Union and the negotiations going on now, there is going to be a significant risk for headlines to come across the wire to move this market. I still believe that the buyers are starting to get involved, perhaps we are going to consolidate between the 1.26 at the 1.28 handle, but it is too early to tell. Ultimately, once we break out of this range, the market will tell us which way it wants to go over the longer term. At that point, it’s easy to follow. In the meantime, I would expect a lot of back and forth trading, so you will probably have to be nimble to trade this pair, or at least trade small positions so that you don’t get hurt rather rapidly as the market will be very violent as we try to figure out where we are going to go longer term. The trade negotiations of course will have a lot of false bravado, and that can scare traders as well.

GBP/USD Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement