Advertisement

Advertisement

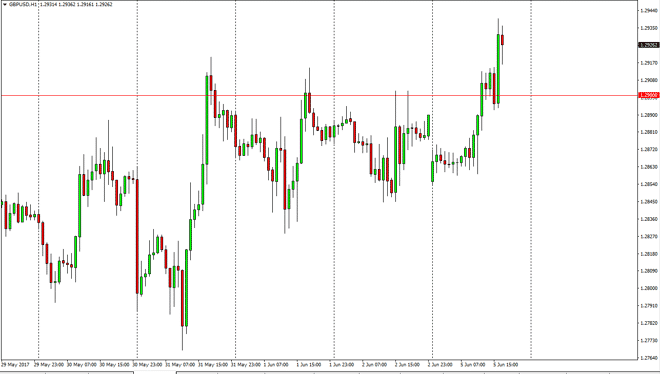

GBP/USD Forecast June 6, 2017, Technical Analysis

Updated: Jun 6, 2017, 05:56 GMT+00:00

The GBP/USD pair initially gapped lower at the open on Monday, but then went sideways for several hours. After that, the market broke higher, reaching

The GBP/USD pair initially gapped lower at the open on Monday, but then went sideways for several hours. After that, the market broke higher, reaching above the 1.29 level above. That was a resistance barrier that has now been shattered later in the day. It looks as if the market will probably find this area supportive going forward as the resistance should now be the “floor.” I believe that given enough time, the market will probably go looking for the 1.30 level above, which of course is a large, round, psychologically significant number. Buying pullbacks that show signs of support or perhaps even short-term bounces will be the best way to play this market going forward. The elections of course are coming on Thursday and that will have a massive influence on the British pound, so I think that we might get a bit of clarity once that happens.

Choppiness between now and then

I believe that choppiness will happen between now and then, as a lot of traders will try to “bet” on the outcome. Ultimately, I think that the British pound is go higher over the longer term, but it’s going to be a bit of choppiness between here and the 1.3450 level above which is the top of the consolidation area. The market breaking down from here could happen as well, especially if it looks as if the parliamentary elections favor the Labour Party, or at least don’t give the Conservative Party a large majority. This would be a sign that the British government may struggle to come to a consensus when it comes to dealing with the European Union exit. Ultimately, I still favor the upside but the elections could draw monkey wrench into the entire thesis that I have been trading on.

GBP/USD Video 06.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement