Advertisement

Advertisement

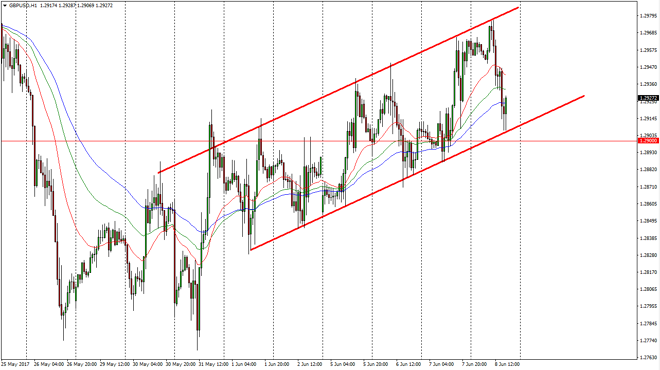

GBP/USD Forecast June 9, 2017, Technical Analysis

Updated: Jun 9, 2017, 04:21 GMT+00:00

The British pound fell during most of the session on Thursday, as the election of Parliament took center stage. Currently, it appears that the

The British pound fell during most of the session on Thursday, as the election of Parliament took center stage. Currently, it appears that the Conservative party will probably pick up a few seats, and therefore we are starting to see the market solidify a bit. Also, the 1.29 handle below has been very supportive so the fact that we would bounce from that general vicinity is not a huge surprise. The market has been in an uptrend channel for some time, and that proves to be holding as I write this. However, the election results are not out yet, so this of course could change very rapidly.

Buying on the dips

It looks like the market continues to buy on dips, and that we are going to go looking for the 1.3050 level above which was resistive. If we can break above there, the market should continue towards the 1.3450 level. That’s my longer-term target, and that has not changed unless of course we get some type of massive surprise in the election. That doesn’t mean that it will be easy to get there, but I do think that’s where the market is trying to get longer term. With this, I continue to buy on the dips and recognize that it may be a lot of “In-N-Out” trading that we see over the next several weeks. If we did breakdown below the 1.29 level, I’m not ready to sell quite yet, because I see so much in the way of support at various levels down to the 1.2750 level. Ultimately, the market has an upward bias but course will continue to be headline driven as we discussed the United Kingdom departing the European Union over the next several months. It’s not going to be easy, but I still believe that the buyers have the upper hand.

GBP/USD Video 09.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement