Advertisement

Advertisement

GBP/USD Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:48 GMT+00:00

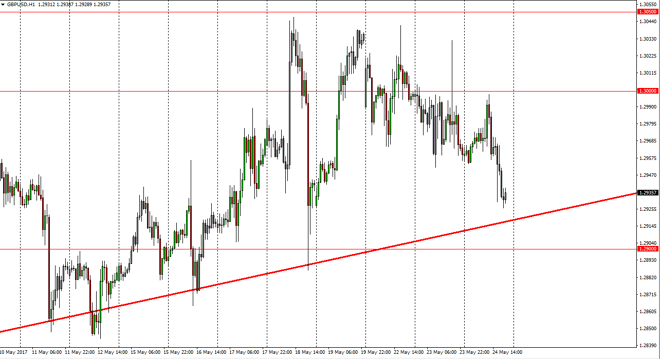

The British pound initially tried to rally during the day on Wednesday, testing the 1.30 level above. That’s an area that has been important more than

The British pound initially tried to rally during the day on Wednesday, testing the 1.30 level above. That’s an area that has been important more than once, so if we can break above there it would be a very bullish sign. Ultimately, the uptrend line that I have been paying attention to has held as I record this, so I believe that there is a possibility the buyers are going to enter the market rather quickly. If we do breakdown below the uptrend line, then I think the market will test the 1.29 handle, which will also be supportive. A breakdown below there should be a negative sign for the short-term, but I think there’s even more support below.

Turning around?

Currently, looks as if we are trying to turn around, but it will be a very volatile currency pair as we are looking at a situation where headlines coming out of both London and Brussels can move the markets very suddenly. With that being the case, it’s likely that the conditions going forward are going to be very choppy, and this should be something to keep in mind as position sizes might need to be smaller. However, if we rally from here I think this is a longer-term moved to the upside just waiting to happen, so therefore the position size doesn’t need to be as big. This could be more of an investment, reaching towards the 1.3450 level above.

Alternately, if we break down below the 1.2750 level, the market will then fall apart and go back into a bearish longer-term move. With this being the case, it’s very likely to fall precipitously if that happens. I still have a bullish bias, but I recognize there’s a lot of noise just waiting to happen.

GBP/USD Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement