Advertisement

Advertisement

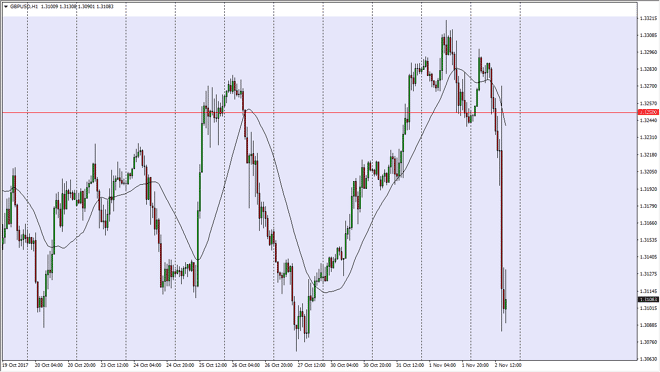

GBP/USD Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:15 GMT+00:00

The Bank of England raised interest rates for the first time in a decade during the session on Thursday, but then suggested that future interest rate

The Bank of England raised interest rates for the first time in a decade during the session on Thursday, but then suggested that future interest rate hikes would be gentle, and not necessarily as rapid as most traders may had anticipated. Ultimately, this then puts the focus on the Federal Reserve, as it is likely to raise interest rates at least 2, if not 3 times over the next year. With this being the case, the British pound may continue to struggle, but we have a significant support just below the 1.31 region, extending down to the 1.30 level. Because of this, I think it’s likely that we will bounce, but if we were to break down below the 1.30 level, the market could fall rather significantly.

With Mark Carney’s somewhat dovish, and perhaps cautious, comments, it’s likely that we will see the British pound struggle to break above the 1.3650 level as it is the scene of the surprise vote that sent the British pound much lower. If we can break above that level, that’s obviously a very bullish sign, but I think it’s an almost impossible situation. I think that selling the rallies will probably continue to be the best way to trade this market, at least for short-term traders. Longer-term, if we can break out to the upside then it becomes more of a buy-and-hold situation, perhaps even then becomes an investment. This is a market that will continue to be very noisy, so keep that in mind but I think that the Bank of England has done everything you can to keep the British pound soft, and I believe that the US dollar will continue to strengthen in general, especially considering that the Federal Reserve has been so hawkish.

GBP/USD Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement